|

As solar and renewable energy measures took center stage at the Legislature on Wednesday, a national group reported that Nevada more than doubled its solar capacity in 2016 to 2,191 megawatts over 1,033 megawatts in 2015. LAS VEGAS REVIEW-JOURNAL — Nevada had the fourth-fastest growth of any state last year and is now the fourth-largest solar state, moving up one spot from last year, according to the report from GTM Research and the Solar Energy Industries Association.

Utility-scale projects boomed in Nevada in 2016, even while residential projects slowed due to changes in the state’s net metering policy that significantly slowed rooftop solar installations, the solar association reported. Nationally, the U.S. solar market had its biggest year ever in 2016, nearly doubling its previous record and adding more electric generating capacity than any other source of energy for the first time ever. The findings are in the U.S. Solar Market Insight 2016 Year-in-Review report. “It would be hard to overstate how impressive 2016 was for the solar industry,” said Abigail Ross Hopper, the group’s president and CEO. “Prices dropped to all-time lows, installations expanded in states across the country and job numbers soared.” The Nevada Legislature on Wednesday heard testimony in support of Assembly Bill 206 by Assemblyman Chris Brooks, D-Las Vegas. It would increase the state’s renewable portfolio standard to 50 percent by 2030 and 80 percent by 2040. One supporter was Sig Rogich, a board member of the Clean Energy Project advocacy group and president of The Rogich Communications Group, who said in a statement: “Nevada needs to continue to update its RPS to better reflect the growing market demand for clean power and Nevada’s potential to become the nation’s leading producer and consumer of renewable energy.” Rogich said the bill sets an aggressive but achievable goal that may have amendments along the way, “but it’s an intelligent approach to attract increased clean energy investment and new clean energy jobs.” Many speakers testified in support of the bill. Prior to the hearing held in the Assembly Commerce and Labor Subcommittee on Energy, Assemblyman Justin Watkins, D-Las Vegas, introduced Assembly Bill 270, which would restore full retail-rate net metering for Nevada rooftop solar customers. “This bill would reinstate one of the most important state policies for empowering consumers to produce their own solar power,” Watkins said.

1 Comment

Colorado’s solar power capacity shot up an impressive 70 percent in 2016, but the state still lost its top 10 ranking after solar capacity across the nation nearly doubled, according to the U.S. Solar Market Insight Report out Thursday. THE DENVER POST — The state’s capacity for generating electricity from the sun rose from 544 megawatts in 2015 to 926 megawatts last year, according to data from the Solar Energy Industries Association (SEIA) and GTM Research.

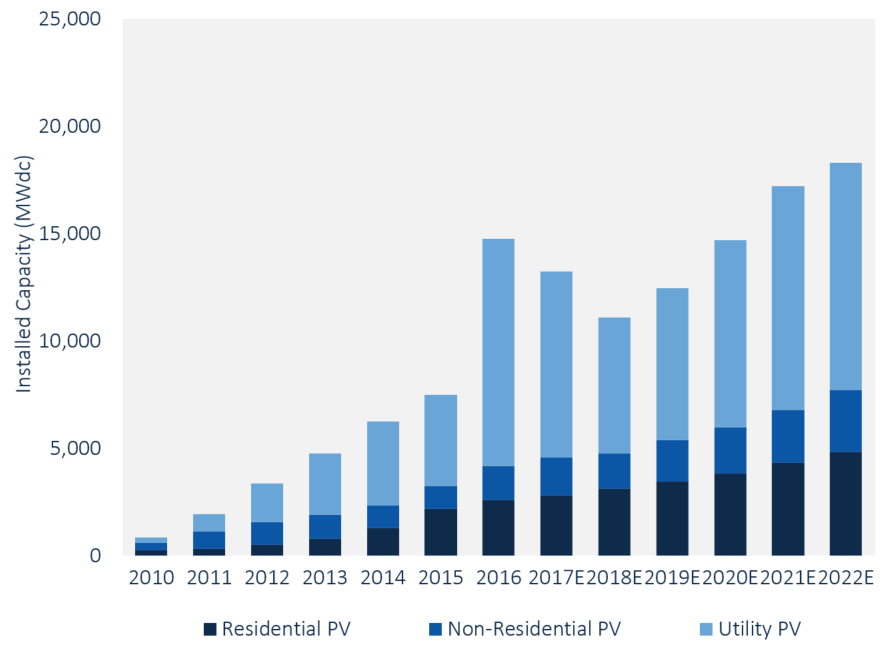

But some states added even more capacity. For example, Utah installed 1,200 megawatts of solar capacity last year and leapfrogged over Colorado to No. 6 in national ranking. Colorado, which ranked ninth for solar capacity installed in 2015, slipped to 11th last year, behind New York. “The reason we are dropping is because after early Colorado leadership in solar, other states are catching up and passing us through innovative policies,” said Rebecca Cantwell, executive director of the Colorado Solar Energy Industries Association. The group is pushing policies that will keep Colorado a leader in solar energy, she said. Of the solar capacity added nationally last year, residential installations totaled 2,583 megawatts, 1,586 megawatts came in non-residential projects including community solar gardens, and 10,593 megawatts came in utility-scale projects, said Justin Baca, vice president of research and markets at SEIA. Numerous residential and commercial systems are needed to equal one utility-scale project, which are more cost-efficient than the smaller installations. States that add utility-scale projects are quickly moving up the national rankings. Uncertainty about the fate of a 30-percent federal tax credit for solar installations pushed some utilities and developers to complete projects in 2016. Congress decided to slowly phase that credit out through 2023. It’s expected the U.S. will add about 10 percent less solar power capacity this year than last. But over the next five years, the nation should see its solar-power capacity triple, Baca said. Falling costs likely will boost growth. The cost of solar photo-voltaic systems fell a record 20 percent last year. Each drop in price strengthens the economic argument to add the alternative energy source. The Navajo Generating Station is the seventh largest source of climate pollution in the country. When it closes in 2019, it will be because of economics—not regulation. FAST CO.EXIST — Three years ago, the EPA struck a deal with the owners of the largest coal plant in the Western U.S. to close the plant by 2044. Now—because of economics, not regulation—the owners plan to shut the plant down by 2019 instead.

The Navajo Generating Station, 12 miles from the Grand Canyon near Page, Arizona, is the seventh largest individual source of climate pollution in the country, pumping out more than 14 million metric tons of carbon dioxide emissions a year. It's also a major source of air pollution for people living nearby; by some estimates, shutting it down will also save more than $127 million a year in health costs. Both the plant and the nearby coal mine also use a significant amount of water that would otherwise be used as drinking water for the Navajo Nation. "It's clean water that they're using," says Percy Deal from Dine Care, a local Navajo environmental group. "I really believe that it's time to put an end to that. That 31,000 acre-feet of water is Navajo water, and for almost 50 years now, Navajos have not been able to use it." While Navajos have experienced the negative effects of the plant and mine, the power has been sent elsewhere; 18,000 homes on the reservation still don't have electricity. Like other coal plants, the Navajo Generating Station has been struggling to compete with cheap natural gas. The plant's customers have been paying more than they would otherwise. The Central Arizona Project, one of the main purchasers of power, reported in a recent presentation that they could have saved $38.5 million in 2016 by purchasing power at standard market rates instead of the coal plant. Coal plants also face competition from renewables, at a time when demand for new electricity in the U.S. is growing slowly. "As new gas-fired and renewable resources are being added every month, this means that more supply-side resources are competing for the same or almost the same demand," David Schissel, director of resource planning analysis at the Institute for Energy Economics and Financial Analysis, tells Co.Exist. "This is not good for coal." Despite Trump's promises to "bring back coal," it's unlikely that policy can make much of a difference. "The market forces working against coal are inexorable," Schissel says. "Maybe by throwing lots of money at coal, eliminating environmental regulations, and trying to slow down the development of renewables, the new administration can slow the pace at which coal plants will be retired in the near future, but it can’t stop the process entirely or reverse it." The new administration also plans to increase production of natural gas, which would further hurt coal. Wind and solar power are also so cheap now that it makes economic sense to continue to build new renewable power. The Navajo plant has also lost major customers recently. The electric utility in Los Angeles sold off its stake in the plant in part because of California's cap and trade program, which limits the amount of climate pollution utilities and companies can release. A Nevada electric company also pulled out of the plant in order to reduce emissions It's the latest of many coal plants to plan to close. Less than three weeks ago, Dayton Power and Light announced that it would close two large coal plants in Ohio in 2018, and develop new solar and wind projects. Duke Energy has closed 12 coal plants over the past five years, with another scheduled to close in 2020. Tennessee Valley Authority has closed three coal plants since 2011. The trend will continue. "The market forces working against coal are not going away," says Schissel. "What the owners of Navajo have been saying about the economics of their plant is reflective of what’s happening to the entire industry." At the Navajo plant, which is a major employer in the area and also provides revenue for the tribe, some members of the Navajo nation are lobbying Trump to intervene and keep the plant open. But better jobs could be on the horizon; the site happens to be one of the best locations for solar development in the country, and solar power is now one of the fastest-growing sources of new American jobs. "The Navajo Nation and the Hopi tribe are concerned about the revenue that they're collecting from these industries, and rightfully so," says Deal. "But they knew that the end was coming and there should have been preparation to replace that revenue. There is the opportunity to do that within the next couple of years, which is to really sit down and talk about a cleaner industry—for example, solar and wind . . . The transmission lines are already there." The U.S. solar market had its biggest year ever in 2016, nearly doubling its previous record and adding more electric generating capacity than any other source of energy for the first time ever. Over the next five years, the cumulative U.S. solar market is expected to nearly triple in size, despite a slight dip expected in 2017. GREENTECH MEDIA — GTM Research and the Solar Energy Industries Association (SEIA) announced these historic figures today with the publication of the U.S. Solar Market Insight 2016 Year in Review report. On average, U.S. solar photovoltaic (PV) system pricing fell by nearly 20 percent in 2016. This is the largest average year-over-year price decline since GTM Research began modeling pricing in this report series. “It would be hard to overstate how impressive 2016 was for the solar industry,” said Abigail Ross Hopper, SEIA’s president and CEO. “Prices dropped to all-time lows, installations expanded in states across the country, and job numbers soared. The bottom line is that more people are benefiting from solar now than at any point in the past, and while the market is changing, the broader trend over the next five years is going in one direction -- and that’s up.” The report forecasts that an impressive 13.2 gigawatts of solar PV will be installed in the U.S. in 2017 -- a 10 percent drop from 2016, but still up 75 percent over 2015. The dip will occur solely in the utility-scale market, following the unprecedented number of utility-scale projects that came on-line in the latter half of 2016, most originally scheduled for completion before the expected expiration of the federal Investment Tax Credit, which has since been extended. By 2019, the utility-scale segment is expected to rebound, with year-over-year growth across the board. “Though utility PV will reset from an origination perspective starting in 2017-2018, distributed solar is largely expected to continue to grow over the next few years due to rapid system-cost declines and a growing number of states reaching grid parity," said Cory Honeyman, associate director of GTM Research. "That said, ongoing net metering and rate design battles -- in conjunction with a declining incentive environment for non-residential PV -- will continue to present risks to distributed solar growth." Twenty-two states each installed more than 100 megawatts of solar in 2016, up from just two states in 2010. There was high growth in states that are not known for their solar market, including Georgia, Minnesota, South Carolina and Utah.

GTM Research expects the residential segment to grow 9 percent in 2017. California, which has historically accounted for nearly half of the U.S. residential market, is expected to decline in 2017; however, 36 of the 40 tracked states will grow year-over-year. The non-residential market is expected to grow 11 percent year-over-year and install a record 1,756 megawatts. The community solar market nearly quadrupled from 2015 to 2016 due to major installations in Minnesota and Massachusetts, and community solar is anticipated to represent 30 percent of the non-residential market in 2018. By 2019, the U.S. solar market is expected to resume year-over-year growth across all market segments. And by 2022, 24 states will be home to more than 1 gigawatt of operating solar PV, up from nine today. Key Findings

On Tuesday, Amazon said that it would install solar panels on 15 of its fulfillment and sorting centers around the US in 2017. That may not seem like a lot, but the massive warehouses in California, New Jersey, Maryland, Nevada, and Delaware account for millions in rooftop square footage and will ultimately reflect 41MW of installed capacity. ARS TECHNICA — “Depending on the specific project, time of year, and other factors, a solar installation could generate as much as 80 percent of a single fulfillment facility’s annual energy needs,” Amazon wrote in a press release. That energy will provide electricity for everything from keeping the lights on to powering Amazon Robotics at fulfillment centers.y for as much renewable energy as all of its data centers and offices worldwide consumed. The search giant said at the time that the move to renewable energy wasn’t just for show—it was about avoiding energy price fluctuations in the long term.

That’s a sentiment Amazon echoed as well in its Tuesday press release. “We are putting our scale and inventive culture to work on sustainability—this is good for the environment, our business, and our customers," wrote Dave Clark, Amazon’s senior vice president of worldwide operations. "By diversifying our energy portfolio, we can keep business costs low and pass along further savings to customers. It’s a win-win.” Tesla—maker of electric cars, batteries, and residential solar panels—has planned a massive solar array for the roof of its Nevada Gigafactory. General Motors is also embracing solar, and it announced last year that the company would move to 100 percent renewable energy by 2050. Amazon has built out wind and solar farms in Texas, Indiana, North Carolina, Ohio, and Virginia to mitigate the tremendous amount of power needed to sustain its data centers around the US. Amazon said it was the top corporate purchaser of renewable energy in the US in 2016. In its press release, the company added that “to date, Amazon has announced or commenced construction on projects which will generate a total of 3.6 million MWh of renewable energy.” Despite the obvious symbiosis that solar panels and warehouse rooftops could share, commercial-scale solar is one of the slowest-growing markets for the solar industry. Utility-scale and even residential-scale have outstripped commercial for a few years now. Imagine a solar panel that generates energy not just from the sun, but also from the rain that hits it. Scientists have combined an electron-enriched graphene electrode with a regular solar cell in order to create just that. GIZMODO — Researchers say the all-weather solar cells are "promising in solving the energy crisis". The study explains:

The new solar cell can be excited by incident light on sunny days and raindrops on rainy days, yielding an optimal solar-to-electric conversion efficiency of 6.53 per cent under AM 1.5 irradiation and current over microamps as well as a voltage of hundreds of microvolts by simulated raindrops. The formation of π-electron|cation electrical double-layer pseudocapacitors at graphene/raindrop interface is contributable to current and voltage outputs at switchable charging–discharging process. The new concept can guide the design of advanced all-weather solar cells. Because raindrops contain salts that split into positive and negative ions, graphene sheets can be used to bind the positive ions, creating a pseudocapacitor which generates electricity thorough simple chemical reaction. The project is still very much in the early stages, but the researchers are excited by the progress. A $1.5 billion investment allowed New York State to increase its solar power usage by almost 800% in the past five years, from 83.06 MW in 2011 to 743.65 MW in 2016. FUTURISM — Initiatives and investments by states like New York bring us one step closer to a fossil-free future that will not only help the environment but save us money as well.

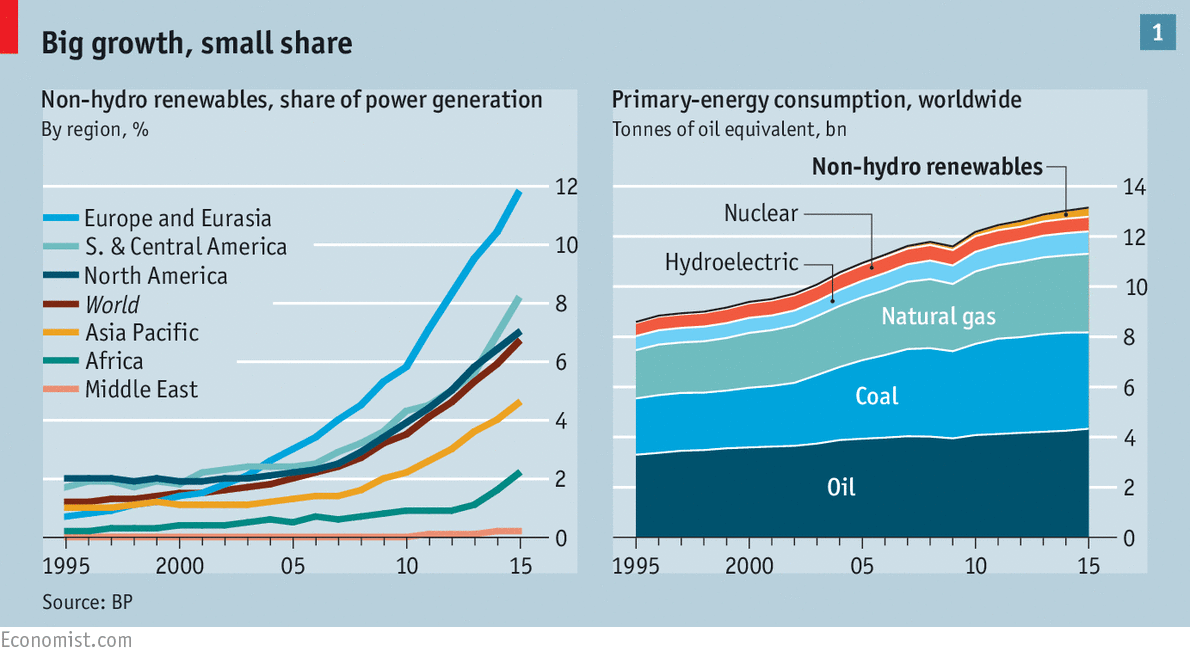

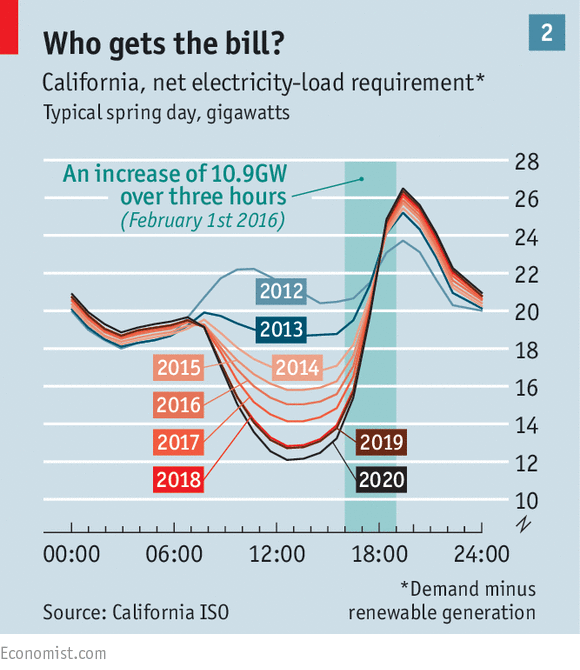

A National Leader New York is putting its money where its mouth is when it comes to a clean energy commitment. The state boasts an almost 800 percent increase in solar power over the past five years. According to a statement made earlier this week by Governor Andrew M. Cuomo, “New York is a national leader in clean energy, and the tremendous growth of the solar industry across this state demonstrates this renewal technology’s increased accessibility and affordability for residents and businesses.” The state generated 83.06 MW of solar power in 2011. Last year, that increased by 795 percent to 743.65 MW. The state has invested $1.5 billion in the renewable source of energy, and its governor recognizes the massive impact renewable energy has on the economy. “Our investments in this clean energy resource create jobs, reduce carbon emissions, support economic growth, and help build a cleaner, greener New York for all,” said Cuomo. National Push Forward This kind of push to greater reliance on renewable sources of energy is not isolated to any one state. States across the country and even countries around the globe are moving to decrease fossil fuel use. Now that solar power is the cheapest source for new energy, it has become fiscally responsible on top of it already being environmentally prudent. Other states getting in on the clean energy action include Nevada, with its push to rely on renewable sources for 80 percent of its electricity demand, and Massachusetts, with its proposal to switch to 100 percent renewable sources by 2035. The U.S. has the power to generate 25 percent of its energy demand from rooftop solar panels alone using current technology. Predictions were made a century ago that nobody would be using coal by 2017. While that prediction has not come to complete fruition, it may turn out that it wasn’t too far off the mark. Wind and solar energy are disrupting a century-old model of providing electricity. What will replace it? THE ECONOMIST — FROM his office window, Philipp Schröder points out over the Bavarian countryside and issues a Bond villain’s laugh: “In front of you, you can see the death of the conventional utility, all financed by Mr and Mrs Schmidt. It’s a beautiful sight.” The wind blowing across Wildpoldsried towards the Alps lazily turns the turbines on the hills above. The south-facing roofs of the houses, barns and cowsheds are blanketed with blue photovoltaic (PV) solar panels. The cows on the green fields produce manure that generates biogas which warms the Biergarten, the sports hall and many of the houses where the 2,600 villagers live, as well as backing up the wind and solar generators in winter. All told, the village produces five times more electricity than it needs, and the villagers are handsomely rewarded for their greenness; in 2016 they pocketed about €6m ($7m) from subsidies and selling their surplus electricity. It hardly looks like the end of the world; but Mr Schröder, who works at Sonnen, an energy-storage firm, has a point. Many environmentalists want the world’s energy system to look like Wildpoldsried’s. And the things it is based on—subsidies for investment, very little spending on fuel, and moving electricity generation to the edge of, or off, the grid—are anathema to electricity markets and business models developed for the fossil-fuel age. Few greens would mourn them. But the fall in utility revenues that comes with the spread of places like Wildpoldsried is not just bad news for fossil-fuel-era incumbents in the generation and transmission businesses. It is also becoming a problem for the renewables themselves, and thus for the efforts to decarbonise the electricity supply that justified their promotion in the first place. In 2014 the International Energy Agency (IEA), a semi-official forecaster, predicted that decarbonising the global electricity grid will require almost $20trn in investment in the 20 years to 2035, at which point the process will still be far from finished. But an electricity industry that does not produce reliable revenues is not one that people will invest in. Less dear, still disruptive The fight against climate change has seen huge growth in the “new” renewables, wind and solar power, over the past decade, both in developed countries and developing ones. In 2015 governments poured $150bn into supporting such investment, with America, China and Germany taking the lead. But Wildpoldsried is still very much the exception, not the rule. In 2015 such sources accounted for only 7% of electricity generated worldwide. Over 80% of the world’s energy still comes from fossil fuels (see chart 1). In terms of reducing climate risks there is a long way to go. The good news is that a decade of subsidy-driven growth has brought with it falling costs. Renewables are still on the pricey side in many places, but they are getting less so; in some places wind, in particular, is reasonably competitive. This suggests that their growth might soon need a lot less subsidy than it has attracted to date. Robust carbon prices would give renewables further advantages, but they have as yet proved hard to provide. The EU’s emissions-trading scheme is a perennial disappointment: still, hope springs eternal, as witness a recent attempt to persuade the new American administration of the benefits of a revenue-neutral economy-wide carbon tax devoted to providing $2,000 to every family of four in rebates. But pushing renewables into the electricity market has had effects on more than their price; it has hit investment, too. In rich countries governments have imposed renewables on electricity systems that had no need for new capacity, because demand is in decline. Investment in supply beyond what the market required has produced gluts and pushed down prices. In America this has been somewhat masked by the shale-gas revolution, which has caused a bigger shift in the same direction. In Europe the glut of renewables is more starkly seen for what it is. Wholesale electricity prices have slumped from around €80 a megawatt-hour in 2008 to €30-50 nowadays. The result has been havoc for the old-style utilities. Germany’s biggest electricity companies, E.ON and RWE, both split in two last year, separating their renewables and grid businesses from indebted and loss-making conventional generation. EY, a consultancy, calculates that utilities across Europe wrote off €120bn of assets because of low power prices between 2010 and 2015. Investment in non-renewables is very low. “Never in recent history has the deployment of capital been more difficult than it is right now within the energy industry,” says Matt Rennie, who analyses the global-utilities market at EY. It is not just that efforts to shift to renewable power have added new sources of supply to an already well-served market. In an industry structured around marginal costs, renewables have a disruptive punch above their weight. Electricity markets, especially those that were deregulated in the late 20th century, typically work on a “merit order”: at any given time they meet demand by taking electricity first from the cheapest supplier, then the next-cheapest, until they have all they need; the price paid to all concerned is set by the most expensive source in use at the time. Because wind and solar do not need to buy any fuel, their marginal costs are low. They thus push more expensive producers off the grid, lowering wholesale prices. If renewables worked constantly that would not, at first blush, look like a problem for anyone except people generating expensive electricity. But renewables are intermittent, which means that in systems where the infrastructure was designed before intermittency became an issue—almost all of them, in practice—fossil-fuel, hydroelectric and nuclear plants are needed more or less as much as ever at times when the sun doesn’t shine and the winds don’t blow. And if such plants are shut out of the market by low-cost renewables, they will not be available when needed. In the long run, and with massive further investments, electricity grids redesigned for systems with a lot of renewable energy could go a long way to solving this problem. Grids with lots of storage capacity built in; grids big enough to reach out to faraway renewables when the nearby ones are in the doldrums; grids smart enough to help customers adapt demand to supply: all have their champions and their role to play. But long-run solutions do not solve short-term constraints. So for now countries with lots of renewables need to keep older fossil-fuel capacity available as a standby and to cover peaks in demand. This often means additional subsidies, known as capacity payments, for plants that would otherwise be uneconomic. Such measures keep the lights on. But they also mean that fossil-fuel production capacity clings on—often in particularly dirty forms, such as German power stations powered by brown coal, or backup diesel generators in Britain. From dull to death spiral Properly structured capacity payments make it sensible to invest in generators that can be switched on when renewable energy is not available. But what will make it sensible to continue investing in renewables themselves? When they are a small part of the system, renewables are insulated from the effects that their low marginal costs have on prices, because as long as there are some plants burning fossil fuels the wholesale price of electricity will stay reasonably high. So utilities could buy electricity from renewable generators, often on fixed-price contracts, without too much worry. But the more renewable generators there are, the more they drag down prices. At times when renewables can meet all the demand, making fossil-fuel prices irrelevant, wholesale electricity prices collapse—or sometimes turn negative, with generators paying the grid to take the stuff away (the power has to go somewhere). The more renewables there are in the system, the more often such collapses occur. Rolando Fuentes of Kapsarc, an energy think-tank based in Saudi Arabia, claims the world is caught in a vicious circle: subsidies foster deployment of renewables; renewables depress power prices, increasing the need for financial support. Theoretically, if renewables were to make up 100% of the market, the wholesale price of electricity would fall to zero, deterring all new investment that was not completely subsidised. He calls this vicious circle the clean-energy paradox: “The more successful you are in increasing renewables’ penetration, the more expensive and less effective the policy becomes.” Francis O’Sullivan, of the Massachusetts Institute of Technology, says the trend is already visible in parts of America with abundant solar energy. Utilities which are required to have renewables in their portfolios, such as those in California, used to offer companies investing in that capacity generous long-term contracts. But research by Bloomberg New Energy Finance (BNEF), a consultancy, shows that, as such utilities come closer to meeting their mandates, solar-power developers are being offered shorter-term fixed prices with a higher subsequent exposure to variable wholesale prices. That reduces the incentive to invest. Solar “cannibalises its own competitiveness away,” Mr O’Sullivan says. “It eats its own tail.” At the turn of the century, according to the IEA, one third of investment in electricity markets flowed into “competitive” sectors that were exposed to wholesale prices; the rest went into regulated utilities, transmission grids and the sort of fixed-price contracts where the renewables got their start. By 2014 the share of investment in the competitive sectors was just 10% of the total. It is a fair bet that, the more renewables are exposed to competition by contracts pegged to wholesale prices, the more people will shy away from them as well. Ever-lower capital costs, particularly in solar, could go some way to bucking this trend, making investments cheaper even as they become more risky.But if low-marginal-cost renewables continue to push prices down, there will come a time when private investment will dry up. As Malcolm Keay of the Oxford Institute for Energy Studies puts it, “The utility business model is broken, and markets are, too.” Renewables do not just lower prices; when used by customers, they also eat into demand. Consider Australia. It has 1.5m households with solar cells on their roofs. There are a number of reasons for this. It is a sunny place; installing PVs was until recently generously subsidised; and electricity bills are high. In part that is to pay for some of the subsidies. In part it is because they pay for the grid, which has been becoming more expensive, not least because it has had to deal with a lot more renewables. The IEA says that in parts of southern Australia, grid upgrades have doubled network costs since 2008-09. Despite cuts to subsidies, Australian PV installations are expected to triple over the next decade. When fewer people rely on the grid, there are also fewer left to share the costs. Phil Blythe of GreenSync, a Melbourne-based company that works with utilities to moderate the fluctuations of renewable energy, warns that his country faces an incipient “utility death spiral”. The more customers generate their own electricity, the more utilities have to raise prices to the customers that remain, which makes them more likely to leave the grid in turn. It won’t happen overnight, he says: but it is “death by a thousand cuts”. From dromedary to duck In California there is an icon for the effect that domestic renewables have on the demand for grid electricity, and thus on the revenues of utilities: it is called the duck (see chart 2). Every year more Californian consumers have solar cells. As a result, every year electricity demand during the day falls, and revenue falls accordingly. Similar effects are seen in Germany, where there are now 1.4m PV users—mostly domestic. It is one of the reasons—subsidies are another—why domestic electricity prices have stayed high there while wholesale prices have fallen. These home generators are not just reducing demand for grid electricity; often they are allowed to feed surplus power from their PVs into the grid, competing with other generators. In many American states utilities grumble about the “net metering” rate they are required to pay such people—especially in states like Nevada where they have been required to credit the electricity fed in at the retail price, rather than the wholesale price. And rooftop solar installations continue to grow, with 12 states more than doubling their deployment in 2016, according to BNEF. Businesses and industrial users are also becoming big consumers of renewable energy, which potentially reduces their dependence on the grid, and thus the amount they will pay for its services. The response to these problems is not to abandon renewables. The subsidies have helped costs of wind and solar to fall precipitously around the world. Competition is often fierce. Recent auctions for offshore wind farms in the North Sea and solar developments in Mexico and Abu Dhabi have shown developers slashing prices to win fixed contracts to supply clean electricity for decades to come. The “levelised cost of electricity” for renewables—the all-in cost of building and operating a plant over its lifetime—is increasingly competitive with fossil fuels in many places. Especially in sunny and windy developing countries with fast-growing demand, they offer a potentially lucrative, subsidy-free investment opportunity. But it does mean changing the way the world buys, sells, values and regulates electricity to take account of the new means by which it generates it. “Thinking of wind and solar as a solution by themselves is not enough. You need flexibility on the other side. It only makes sense if this is a package deal,” says Simon Müller of the IEA. Elements of that package are already appearing. Markets that sell commoditised kilowatt-hours need to be transformed into markets where consumers pay for guaranteed services. A lot more storage will be needed, with products like those of Sonnen in Wildpoldsried and the Powerwalls made by Tesla fighting for space in people’s homes. Smart grids bolstered by big data will do more to keep demand in line with supply. It may not get all the way there

In Wildpoldsried Mr Schröder dreams of electricity-users inviting friends round for a glass of wine to show off their new solar kits and batteries. “We’ll soon be at a point where people say, ‘You’re so yesterday. You get your power from the grid.’” But peer pressure is unlikely to be decisive. Bruce Huber of Alexa Capital, which helps fund renewable-energy investments, says business consumers are probably going to be more influential in driving the adoption of these technologies than households, because they will more quickly see how they might cut their bills by using demand-response and storage. “For the last 100 years everyone has made money upstream. Now the added value is coming downstream,” he says. Waiting for enlightenment Mr Huber likens the upheaval facing utilities to that seen in the telecoms industry a generation ago, when a business model based on charging per second for long-distance calls was replaced by one involving the sale of services such as always-on broadband. This is bad news for the vertically integrated giants that grew up in the age of centralised generating by the gigawatt. Jens Weinmann, of ESMT Berlin, a business school, names dozens of tech-like firms that are “nibbling” away at bits of utilities’ traditional business models through innovations in grid optimisation and smart-home management systems. With a colleague, Christoph Burger, he has written of the “big beyond” in which domestic energy autonomy, the use of the blockchain in energy contracts, and crowdsourcing of PV installations and other technological disruptions doom the traditional utility. Already, big Silicon Valley firms such as Google and Amazon are attempting to digitalise domestic energy, too, with home-hubs and thermostats. But how this nibbling leads to a system that all can rely on—and who pays for the parts of it that are public, rather than private, goods—remains obscure. The process will definitely be sensitive to politics, because, although voters give little thought to electricity markets when they are working, they can get angry when prices rise to cover new investment—and they scream blue murder when the lights go out. That suggests progress may be slow and fitful. And it is possible that it could stall, leaving climate risks largely unabated. Getting renewables to today’s relatively modest level of penetration was hard and very expensive work. To get to systems where renewables supply 80% or more of customers’ electricity needs will bring challenges that may be far greater, even though renewables are becoming comparatively cheap. It is quite possible that, as Mr Schröder predicts, Mr and Mrs Schmidt in Wildpoldsried will lay waste the world’s conventional electricity utilities while sharing Riesling and gossip with the neighbours. But that does not mean that they will be able to provide a clean, green alternative for everyone. Solar energy is now cheaper than retail energy in all but one of Australia's capital cities, and 20 new large-scale solar projects are expected to come online in the country in 2017. This trend in Australia is being reflected worldwide, with the cost of solar dropping 58% globally in the past five years and the solar industry now employing more people than coal. 58 PERCENT CHEAPER

According to a recent report by Australian nonprofit, Climate Council, solar energy is now cheaper than retail power in most capital cities in Australia, with prices dropping 58 percent globally in the past five years. With costs expected to drop between 40 to 70 percent more by 2040, we can only expect a rise in adoption and usage in that country and others around the globe. “We are seeing more and more industrial-scale solar coming online across the country and the world. Hospitals, airports, farms and a variety of other businesses have embraced smarter and cleaner power,” Greg Bourne, expert Councillor with the Climate Council, told SBS. Nearly 7,000 solar batteries were installed in Australian homes last year, and that number is expected to triple in 2017. The Council adds in its report that industrial-scale solar plants are now providing cheaper power versus traditional coal plants. Twenty solar power plants are scheduled to be built around Australia, which will see an additional 3,700 megawatts of solar energy — that’s enough to power 600,000 homes. This will no doubt help Australia achieve its goal of reaching 20 gigawatts of solar generation in the next two decades. SOLAR SURGE Transitioning to renewable energy is not only necessary as we continue to see and feel the effects of climate change, it also makes economic sense. Globally, 2.8 million people have jobs in the industry, which is more than those with coal jobs. In fact, in the United States, solar accounts for double the number of jobs as coal. “The era of coal is over and global investment has moved firmly to renewable energy,” added Climate Council in a statement. “Solar power is cheaper, has no fuel costs, is non-polluting and it is clear that it will be a key of Australia’s future.” Along with Australia, countries like China, the U.S., and Japan are at the forefront of renewable energy, with many other countries around the globe following suit. In 2015, a study showed that the U.S. could be completely powered by renewable energy by 2050. In 2016, almost all of Costa Rica’s electricity was generated using renewable sources. Germany, in an effort to phase out nuclear energy, is also well on its way to making other renewable energy sources more viable. As these individual efforts and global ones like the Paris Agreement take shape, we will hopefully see a tangible impact on our environment. Installing solar panels on the roof of your home is a big project – but it can pay dividends in more ways than one. There’s the obvious environmental benefit, but for many homeowners, the joy comes with a dollar sign attached. THE GUARDIAN — Turning your home into a mini power plant can save you good money on your electric bill. Here is a guide to get you started:

An average, 5-kilowatt system will cost about $15,000 to $20,000, depending on where you live in the US. It pays to find out if your state or utility offers rebates or other incentives to help lower the cost of going solar. Here is a sure bet: the federal government offers a 30% tax credit (though it’s set to decline starting in 2020). You can start your research with this federally funded, comprehensive database that lists all sorts of incentives and policies for renewable energy by state. If that seems daunting, then begin your homework by contacting the state agency that regulates utilities. Some states with strong policies to promote solar energy use, such as California, New York and Massachusetts, have created their own websites listing incentives, financing options, and tips for hiring a contractor to install the solar panels. Your utility might offer a similar helpful guide. As with any major home improvement project, finding a good contractor is crucial. A trustworthy installer will secure the necessary permits, properly connect the solar energy system to your home and the local electric grid, and apply for incentives for you. Some states – or local utilities – post a list of certified solar service companies. Many consumers ask friends and neighbors for recommendations. Googling works just as well. Regardless of the approach, you should always get several quotes and chat with the installers to find a good match. Another big decision is how to pay for the equipment and services. You can pay for them outright, of course. A solar energy system lasts about 25 years, so paying for it upfront will be a cheaper option over time than to lease it. As an owner, you get a bonus incentive if you live in a state that allows you to sell excess solar electricity to your utility. The money you earn will show up as a credit on your bill. Another popular option is to leave the ownership and maintenance of the solar panels to your installer (and its investors) and pay only for the electricity produced from the rooftop system. This arrangement is done through what’s commonly called a power purchase agreement, which can last 15 years or more. Your solar company typically sweetens the deal by charging you a lower electric rate than your utility would. Be sure to read the contract to see how your installer sets the electric rates over time. Those rates are likely to change. The solar energy market is growing because the average price for solar energy systems has fallen so much – 54% between 2010 and 2016, according to GTM Research. While your solar panels may not produce all the electricity you need, they are becoming a good investment to lower your bill. |

James Ramos,BPII'm your go to solar energy expert here to guide you step-by-step through all of your solar options. Categories |

James The Solar Energy Expert

RSS Feed

RSS Feed