|

A new study analyzes the value provided by solar + storage systems during grid outages: “Valuing resilience can make PV and energy storage systems economical in cases when they would not be otherwise.”

Power outages caused by extreme weather events serve as all-too-frequent reminders of the vulnerability of buildings to grid disruptions. But what if building owners accounted for the value of avoided grid outages when deciding whether to invest in projects that could supply uninterruptible power after natural disasters? A new study by researchers from the National Renewable Energy Laboratory (NREL) in collaboration with Clean Energy Group, a Vermont-based nonprofit, finds that “accounting for the cost of electric grid power outages can change the breakeven point for PV and storage system investment.” In a summary of a paper submitted for publication, the authors write that “even though a PV and storage system might not appear to be economical under traditional cost-benefit calculations, placing a value on the losses incurred from grid disruptions can make a PV and storage system a fiscally sound investment.” “In most cases,” they add, “incorporating the value of resilience will increase the optimal sizing of both the PV and battery systems.” “It’s clear that placing a value on resiliency does increase the value of the project and increases the value that the combination of solar and energy storage can add to a project,” Seth Mullendore, vice president and project director for the Clean Energy Group, told GTM in an interview. “It definitely adds to the economic viability of a project.” The value of resilience provided by solar-plus-storage in commercial buildingsThe researchers modeled the results of solar and storage projects installed at three types of buildings in Anaheim, California: a primary school, a large office building and a large hotel. To place a value on resilience, the study used the expected cost of a power outage (loss of business or the liability incurred) based on values included in 30 utility customer surveys. The study assumed that solar and storage systems can power critical loads, or about 50 percent of a building’s typical electrical load, during an outage. Modeled outages lasted two hours. Simulated outages were based on the Customer Average Interruption Duration Index values reported by utilities. For each building type, researchers analyzed the net present value (NPV) of the solar and energy storage system. At the primary school, solar-plus-storage was economical even before accounting for the cost of avoided outages. After factoring in the value of avoided grid disruptions, the size of the optimal solar PV system increased by 20 percent to 134 kilowatts and the storage system increased by more than 13 times to 32 kilowatts/79 kilowatt-hours. The NPV under the resilience scenario more than doubled, from $28,759 to $58,399. For the large office building, a solar PV system was economical before accounting for resilience, but an energy storage system was not. After factoring in the cost of avoided outages, the ideal configuration called for a 35 percent larger PV array and a 156-kilowatt/271-kilowatt-hour battery storage system. Combine the value of avoided outage losses with the increased electricity bill savings, and the net benefit for the building owner increased by $178,000 over 20 years. Before placing a value on resilience, neither a solar PV system nor energy storage was cost-effective for the large hotel. After factoring in the value of avoided outages, a configuration with 363 kilowatts of solar PV and a 39-kilowatt/60-kilowatt-hour battery storage system was optimal. “In this case,” the authors write, “valuing resilience enables PV and storage to become the least-cost solution.” The researchers note that building owners should plan for the added cost necessary to make a solar and storage systems islandable. They estimate that the necessary hardware -- including transfer switches, critical load panels, and controls -- could add incremental expenses ranging from 10 percent to 50 percent of the cost of a non-islandable system. Conservative estimates“I would call this a rather conservative estimate of the value you would get for a project from including the resiliency,” said Joyce McLaren, a renewable energy research analyst at NREL, in an interview. “The outages that we were looking at were relatively short compared to something you saw in Puerto Rico or elsewhere after a hurricane.” Mullendore added that the resilience value used in the study -- avoided outages -- doesn’t fully capture the benefits provided by solar and storage systems after natural disasters or other life-threatening emergencies. “When you get into the values when you are talking potential loss of life, or impacting quality of life,” he said, “it gets a lot harder to place a value on, but certainly it is a lot higher than when you’re just talking about business losses.” An opening for solar-plus-storage to replace diesel generatorsMcLaren and Mullendore said they're not aware of any formal government effort to develop a national standard to value the resilience provided by solar and storage systems. But planning for grid disruptions caused by extreme weather events is a mounting priority for government officials. “The reason we were interested in this,” said McLaren, “is resiliency is of increasing interest to a lot of building owners and other stakeholders, particularly city planners and city governments that are concerned about the impacts of power outages for extended periods of time.” Mullendore cited one successful model, Massachusetts’ Community Clean Energy Resiliency Initiative, a $40 million grant program for local government projects that deploy solar panels, energy storage, and other clean energy technologies to avoid service interruptions. Mullendore added that jurisdictions could do more to create an opening for solar-plus-storage systems by revising standards that favor diesel generators as the default backup power source for buildings. “Those standards tend to be written with generators in mind,” he said. “So there’s not an easy opening for new, advanced technologies to play that same role, whether it’s energy storage or fuel cells. New technology solutions need to be allowed to fulfill the same role that generators typically have.”

0 Comments

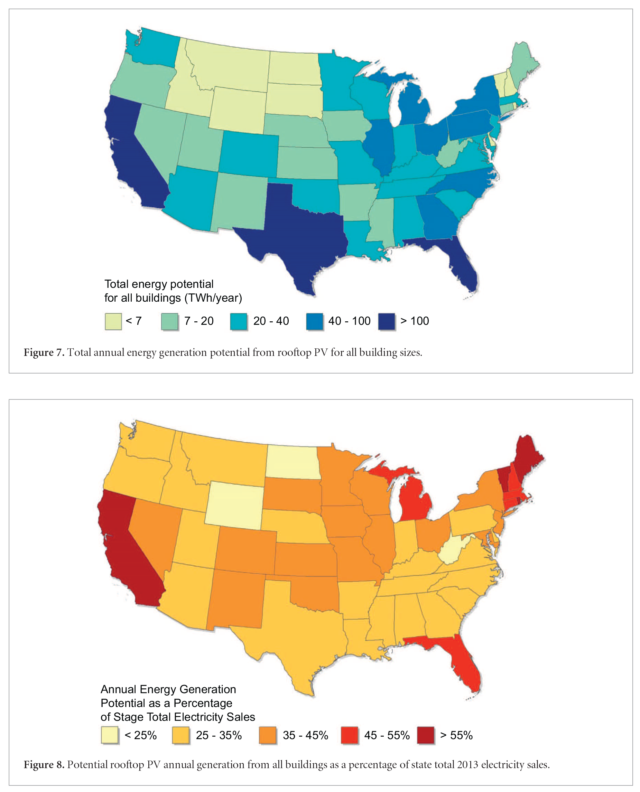

Estimate shows rooftop solar could produce almost 40 percent of our electricity. ARS TECHNICA -- When you’re scoping out possible futures, it’s useful to ask a lot of “what if?” questions. For example, what if we could install solar panels on every suitable roof in the United States? How much electricity would they generate? Plenty of research has followed this line of thought, though much of it has necessarily focused on working out the details for individual cities or regions. But now with enough of these studies in the bank, a group of researchers from the US National Renewable Energy Laboratory decided to take another whack at a national estimate. There are a lot of things you need to know to do this: number of buildings, size of roofs, direction the roofs are facing, strength of sunlight, number of sunny days, and so on. So first off, the researchers took advantage of a Department of Homeland Security program that laser-maps buildings, which now covers almost a quarter of buildings in the US. From this, it's possible to get roof area, roof tilt, roof direction, and whether the roof is shaded by trees. Roofs were tossed out if they were too small, too steep, north-facing, or otherwise would lose more than 20 percent of their possible solar output, but most roofs were suitable. To estimate the rest of the country, the researchers calculated statistics for the covered area and then used things like Census data to scale them for every other ZIP code area. Next, the researchers worked out the average amount of sunlight in a year for each location. Using the average efficiency of rooftop solar panels installed in 2015, they combined everything to produce a map of maximum possible rooftop solar energy production. In total, they estimate that there are a little over 8 billion square meters of suitable roofs in the US. Cover that in solar panels, and you would produce about 1,400 terawatt hours of electricity each year—about two-thirds of which would come from small residential buildings. The total production is equal to nearly 40 percent of the total electricity currently sold by utilities in the US. A simpler 2008 National Renewable Energy Laboratory estimate came in at just 22 percent of electricity—the new estimate shows a higher percentage partly because solar panel efficiency has improved but also because new sources of data made a more accurate estimate possible. Total estimated rooftop solar production by state (top), also shown as a percentage of total electricity use (bottom).

Apart from the big numbers, there are some interesting details at the state or local level. States with strong sunlight and plenty of roofs obviously have the most potential—California, for example, could supply 74 percent of its total electricity use by covering its buildings with solar panels, while Wyoming could only get to about 14 percent. But that’s partly because of different electricity use. New England doesn’t have the sunniest skies, but the limited need for air conditioning in the summer helps keep electricity use down. As a result, that region could produce about half its total electricity from rooftop solar. And if you consider residential buildings separately, they can produce about as much electricity as people use in their homes. Overall, the all-in scenario of slapping solar panels on every single building wouldn’t be enough to replace all our power plants, but 40 percent ain’t bad. More plausible (and less Fiddler-on-the-Roof-If-I-Were-a-Rich-Man) scenarios would obviously stay south of that number. Still, the “what if?” is instructive Three Canadian solar companies are suing the administration, while at least five U.S. trading partners have launched complaints at the WTO.

GREENTECH MEDIA -- The anticipated fallout from the Section 201 solar trade case is now officially underway. Three Canadian solar panel manufacturers launched a lawsuit against the Trump administration at the United States Court of International Trade last week, claiming the new global safeguard measures violate the Trade Act of 1974 and the NAFTA Implementation Act. The complaint was filed on February 7 -- the same day President Trump’s tariff proclamation took effect. The European Union also filed a request for consultations with the World Trade Organization that day, following similar steps taken by China, Taiwan and South Korea. Singapore subsequently filed for consultation at the WTO on February 9. Bilateral consultations between the parties are the first stage of formal dispute resolution. Legal actions follow Trump’s decision in the Section 201 case petitioned by U.S.-based crystalline silicon (CSPV) solar manufacturers Suniva and SolarWorld Americas. In a proclamation issued January 22, Trump decided to impose a 30 percent tariff on imported CSPV solar cells and modules -- set to decline by 5 percentage points per year over the four-year tariff period. The ruling also includes a tariff-free carve-out for the first 2.5 gigawatts of solar cells imported each year. Several developing nations, listed as Generalized System of Preferences beneficiary countries, were exempt from the tariffs because they currently account for a small portion of U.S. solar imports (although that could soon change). In recommendations submitted to President Trump by the U.S. International Trade Commission (ITC) last fall, three of the four commissioners determined that imports from Canada are not harmful to U.S. producers. The fourth commissioner did not explicitly address Canada in her proposal. Despite the negative findings, Trump’s ruling did not exempt companies from north of the border. Similarly, all ITC commissioners exempt U.S. free trade partner Singapore (home to solar manufacturer REC Group) in their recommendations. However, Singapore was not exempt in Trump’s decision. The Canadian lawsuit -- brought by Silfab Solar, Heliene and Canada Solar Solutions -- states that the president’s proclamation is “unlawful as applied to plaintiffs, and inflicts grave and irreversible harms on them.” They are now seeking an injunction prohibiting the enforcement of new tariffs against them. Canadian manufacturers face layoffs and plant closures The case argues that the U.S. violated Sections 201 and 203 of the Trade Act by imposing safeguard measures on Canada without the required recommendation from the ITC. The plaintiffs also claim the U.S. violated Sections 311 and 312 of the NAFTA Act because, as the ITC determined, Canada does not “account for a substantial share of total imports” or “contribute importantly to the serious injury, or threat thereof, caused by imports.” The plaintiffs state that American-based solar manufacturers account for less than 5 percent of CSPV cells and modules used in the U.S., while Canadian manufacturers account for only 2 percent. It’s worth noting Trump decided Generalized System of Preference countries are exempt from the tariffs until they reach 3 percent of U.S. CSPV cell and module imports. If the 2 percent figure cited by Canadian manufacturers is correct, it would seem to represent a reasonable level by the administration’s own standards. But while the effect on the U.S. solar market is minimal, these exports represent the “bulk” of the Canadian solar manufacturing industry, according to a plaintiff memo. Because the plaintiffs produce CSPV modules, and not cells, Canadian solar products are immediately subject to tariffs. “That tariff will make it prohibitively expensive for Plaintiffs to import CSPV modules from Canada to the United States, and within weeks, it will compel Plaintiffs to terminate employees, close manufacturing facilities, forego business opportunities, lose sales, and -- in several cases -- cease business entirely,” the memo states. The Court of International Trade is a special court based in New York City with a very experienced group of judges looking to answer a very specific set of legal questions that differ from the WTO, said Allan Marks, energy and project finance attorney at law firm Milbank, Tweed, Hadley & McCloy. “They’re looking at whether these tariffs, in particular as applied to Canada, comply with U.S. law,” said Marks, who teaches energy trade issues as an adjunct professor at UC Berkeley. “The WTO is looking at whether U.S. government safeguard measures, broadly applied, comply with international law. Those are different questions and the standards are slightly different.” Action at the court level is also likely to be much faster than at the WTO level, which could take 18 months or more. In the Canadian company case, the U.S. government will have to respond within the coming weeks. The administration could choose to act through the courts, or the Office of the U.S. Trade Representative could modify the tariff order to exempt Canada, which would render the case moot. Marks noted the USTR has the authority to change or rescind the tariff at any point. China threatens retaliatory measures At the WTO, there are several different courses of action countries can take to challenge the tariffs. One route is to question whether or not the sudden increase in imports affecting U.S. companies was “unforeseen.” The Trump administration prepared for this challenge by requesting the ITC submit a supplemental report. However, countries can also challenge whether the ITC did a good job in making its determination in the global safeguard case, or they can take issue with how the safeguard measures were implemented. To that end, several complaints submitted to the WTO center on the need for proper “consultation” and “compensation” between trading partners, in accordance with international law. In a global safeguards case, trade authorities only have to find injury against their domestic industry -- they don’t have to prove specific countries have broken the rules, as is required in an anti-dumping and countervailing duties case. As part of the Section 201 process, the U.S. needs to discuss its tariff decision with affected countries prior to applying the safeguard measures, said Marks. “If the WTO finds that our injury finding wasn’t thoroughly done or it didn’t allow proper time for compensation and consultation, then retaliatory compensation would be allowed under international trade rules,” he said. Retaliatory measures played a role in convincing the U.S. government to withdraw tariffs on imported steel products in a Section 201 case decided in 2002. Retaliation is intentionally designed to create political pressure, and is often targeted at unrelated industries, said Marks. Chinese officials have already confirmed they’re launching an investigation into whether about $1 billion of U.S. sorghum exports were being dumped or receiving subsidies -- a move widely viewed as a response to the Trump administration’s protectionist trade policies, The New York Times reports. According to Bloomberg, China is also looking to impose trade restrictions on soybeans imported from the U.S. “If you’re smart, you [retaliate] on things being exported from districts of congressional leaders,” Marks said, assuming the WTO gives the go-ahead. “You could see [countries] imposing it on coal exports. I’ve also heard whiskey or bourbon mentioned. In the past, it was North Carolina textiles. If Paul Ryan is still Speaker of the House, exporting Wisconsin cheese could get harder. Whatever it’s going to be, it’s going to be something that moves the needle politically.” The Trump administration is likely also thinking about the political dynamics. “I don’t think they want to hurt the U.S. economy or even renewable energy; I think they just want to placate their base,” Marks said. “They want to find a way to thread the needle that meets their political goals,” he surmised. “Whether or not it works is another question.” As challenges move forward at the WTO and the New York court, individual companies have until the end of the month to request an exclusion from the new tariffs. With American jobs on the line, this decision also comes with political implications. Renewable energy developers pairing with storage to beat gas.

BLOOMBERG -- Natural gas is getting edged out of power markets across the U.S. by two energy sources that, together, are proving to be an unbeatable mix: solar and batteries. In just the latest example, First Solar Inc. won a power contract to supply Arizona’s biggest utility when electricity demand on its system typically peaks, between 3 p.m. and 8 p.m. The panel maker beat out bids from even power plants burning cheap gas by proposing to build a 65-megawatt solar farm that will, in turn, feed a 50-megawatt battery system. It’s a powerful combination for meeting peak demand because of when the sun shines. Here’s how it’ll work: The panels will generate solar power when the sun’s out to charge the batteries. The utility will draw on those batteries as the sun starts to set and demand starts to rise. Just last week, NextEra Energy Inc.’s Florida utility similarly installed a battery system that’ll back up a solar farm and boost generation. In California, regulators have called on PG&E Corp. to use batteries or other non-fossil fuel resources instead of supplies from gas-fired plants to meet peak demand. The state is adding energy storage to backstop wind and solar power. And batteries may be about to get even more competitive. Federal Energy Regulatory Commission Chairman Kevin McIntyre said he expects the agency to decide Thursday on a proposed rule that could remove barriers to energy storage participating more in wholesale markets. Arizona Public Service Co. spokeswoman Annie DeGraw said the bid the utility received from First Solar was “very competitive, and it had the added benefit of being clean.” Prolonged heat waves are causing canola seed pods to disintegrate, rendering the plants unusable by farmers. Now, researchers have isolated the gene causing this phenomenon, and they may be able to use that knowledge to prevent the loss of future crops.

FUTURISM -- Canola oil is a common ingredient in prepackaged foods. You may even have a container of it in your cabinet right now. However, if a troubling climate change-induced trend continues, you may pay a much higher price the time you purchase the kitchen staple. Heat waves can completely devastate canola crops — the canola seed pods literally disintegrate when exposed to long periods of heat. The seed crop then either falls to the ground on its own or is delivered from its weakened pod by a storm or wind. In the wild, weakened seedpod walls after intense heat make sense as a survival tactic. The growing process is accelerated in the hopes that the seeds will be released before the heat kills the plant. However, seed crops are useless to farmers once they hit the ground. “Farmers of canola worldwide lose about 15 to 20 percent on average of their yield because of this shatter phenomenon,” Lars Østergaard, a biologist at the John Innes Centre, told NPR. “I spoke with a farmer in Kent who lost more than 70 percent of his crop one year because he harvested on a day after a strong storm had come in.” BATTLING THE ELEMENTS To get to the bottom of this issue, Østergaard and other researchers from the John Innes Centre decided to conduct an experiment, the results of which have been published in Molecular Plant. The researchers grew canola and three other types of plants in isolated chambers at 17 degrees Celsius, 22 degrees Celsius, and 27 degrees Celsius (63 degrees Fahrenheit, 72 degrees Fahrenheit, and 81 degrees Fahrenheit, respectively). Next, they monitored the plants for signs of the Indehiscence (IND) gene, which they knew instructed the plants to open their seedpods. The researchers discovered that the plant’s access to this gene increased along with the temperature. The hotter it got, the easier it was for the plant’s cells to carry out the gene’s instructions. Now that the researchers know why heat affects canola plants the way that it does, they might be able to use that information to control the effect of heat on the IND gene, thereby controlling the plant’s reaction to it. “If people are trying to breed crops for not shattering in heat waves, then they have a target gene to work with,” Johanna Schmitt, a plant biologist at the University of California, Davis, who did not work on the study, told NPR. The researchers involved in the study believe other food crops might respond similarly to temperature changes. If they’re right, we’ll need to find ways to ensure other plants aren’t rendered unusable by rising temperatures, and taking a closer look at their genes just might be the best way to do that. Thanks to high electricity prices and low solar installation costs, Australia far exceeds other countries in solar energy adoption.

FUTURISM -- The sunny nation of Australia could double its solar capacity by the end of 2018, analysts predict. The country’s solar energy boom has been spurred by solar projects large and small, with multiple industrial projects paired with the appearance of solar panels on buildings all over the country. The Guardian reports that last month saw the most rooftop solar installations in January to date, and one of the top five months ever, with 69 percent more panels installed compared to the same time last year. The state of New South Wales is also working on ten new solar farm projects approved in 2017, and one approved since the start of the new year. Meanwhile, 18 industrial projects are under construction in neighboring state Queensland, the highest number in the country. John Grimes, chief executive of Australia’s Smart Energy Council, told The Guardian that the solar farms could be built “within a matter of weeks. […] They’re really quick and simple.” According to a blog post by James Martin of SolarChoice, an Australian power broker company, 1 in 5 Australian homes has now solar on its roof. South Australia — the country’s top solar state, and fittingly the location of Tesla’s massive backup battery— sees solar in 30 percent of homes. Compare that to the United States; though the solar industry is rapidly growing, the U.S. Energy Information Administration estimates it makes up about one percent of total electricity generation in the nation. This isn’t just because Australia has more year-round sunshine, though that’s certainly a factor (and a bitter one to acknowledge from within the current Northern Hemisphere winter). Martin explains that electricity prices in Australia are usually high, while solar installations costs in Australia are significantly lower than those in the States. This has driven many a frustrated Aussie to reach for solar panels in the hope of lowering their bills. Worldwide, however, solar energy capacity is skyrocketing, as is that of other renewables like wind energy. As countries transform their energy systems to prevent worsening climate change, it may be best for all to do as they do Down Under. Nissan Motor Co. intends to spend $9 billion over five years in China as it vies to become the largest global electrified vehicle maker in the country.

BLOOMBERG -- The Japanese carmaker aims to raise annual deliveries by 1 million units by 2022, with much of the growth coming from electrified models, Jun Seki, head of Nissan’s China operations, told reporters in Beijing Monday. Nissan, facing a plateauing U.S. market and waning demand at home, is banking on the world’s largest auto market to drive growth over the next five years. Global rivals including Volkswagen AG, General Motors Co., Honda Motor Co. are also investing more in China in the race to become the fastest growing major brand in a country that has focused on putting more electrified vehicles on the road to reduce emissions. Nissan, maker of the Leaf EV and already the largest Japanese carmaker in China, is planning to introduce 20 electrified models by 2022 in China. Under the plan, electrified cars will account for 30 percent of all sales in 2022, and by 2025, all Infiniti models will be electrified. Nissan set up a joint venture with China’s Dongfeng Motor Group in 2003 and in August last year, established a joint venture with Renault SA and Dongfeng to develop electric cars for the local market. The Japanese automaker was initially uncertain about how fast demand would grow for electrified vehicles in China and wanted to avoid over-investing, said Seki. “The growth in local competition has been much faster than we expected,” he said. “Now we have come around to changing our local strategy.” Carmakers from Nissan to VW, Ford Motor Co. and GM are looking for ways to meet China’s emission-reduction requirements. China is implementing a cap-and-trade framework that will penalize companies that don’t meet fleet-based limits on emissions. VW said that along with its partners the company will invest more than 10 billion euros ($12 billion) to make and develop a range of new-energy vehicles in China. Ford said that it will invest 5 billion yuan with partner Anhui Zotye Automobile Co. to produce and sell small electric cars in the country. Chief Executive Officer Hiroto Saikawa, who took the job last year, has said China is key for Nissan. The country will contribute almost a third of its targeted revenue of 16.5 trillion yen by 2022, under the mid-term plan, becoming the single-biggest market for the carmaker. The automaker sold a record 1.52 million vehicles in the country last year, compared with 1.59 million in the U.S., its top market. Winter Olympian Apolo Ohno and soccer players David Villa and Kaká are helping to fund a new push for renewables as the island rebuilds.

FAST COMPANY -- Four months after Hurricane Maria hit Puerto Rico, around 450,000 people still lack power, and the local electric utility–which is on track to run out of money by mid-February without a massive loan–is still struggling to rebuild the grid. A local wind farm has been ready to run since October, but the utility hasn’t let it power up. The same is true of a large solar farm. But smaller solar microgrids, relying on batteries rather than the grid, have been able to quickly provide power to critical locations including hospitals, schools, community centers, a water pumping station, and remote mountain communities. These projects have been donated by companies like Tesla and Sonnen. To scale up to meet demand, though, more funding is needed. A group of pro athletes is hoping to rally fans to raise that money–and if the fundraising goes well enough, the money can also help with a longer-term rebuilding of the island’s electricity system. “We were inspired by my buddy J.J. Watt,” says former NFL player Don Davey, who worked with Viktre, a social network for pro athletes and fans, to create the Viktre Challenge for Puerto Rico, the platform’s first crowdfunding cause campaign. “In a week, just by posting some videos, [J.J.] was able to raise $37 million for Hurricane Harvey relief in Houston. We didn’t set any internal goals, but we said, that’s one guy–he’s obviously a very famous and well-known guy–but if there are 1,300 athletes on our platform, plus all our followers, certainly the potential exists that we could . . . raise a significant amount of money.” From January 22 to February 22, a small group of athletes, including Winter Olympian Apolo Ohno and soccer players David Villa and Kaká, will serve as captains for teams that compete to try to raise the most money for restoring power in Puerto Rico. The money will go to the Foundation for Puerto Rico, a local nonprofit, which will coordinate with companies like Tesla to quickly install new projects. “It’s going to be an immediate impact,” says Alma Frontera, director of strategic projects and alliances for the foundation. “We’re looking at projects where the community is in urgent need.” The systems can be installed quickly, says Davey, who visited the island to see some of the microgrids that Tesla has already installed. “They can come in and literally within six days they had the pumps turned back on for the freshwater supply for the entire island of Vieques,” he says. “Then six days later, they were able to put another installation in and get the hospital up and running.” The cost varies dramatically by the size of a project, but a small system might cost around $40,000, while a larger system could cost $750,000 or more. While any money raised will go first to fill emergency needs, everyone involved hopes that funds can go further to help rebuild larger pieces of the grid with renewable energy. Puerto Ricans pushing for a renewable grid hope to not only solve their immediate humanitarian crisis, but serve as an energy model for other parts of the world. “We’re a small island, and this is going to be such a great case study,” says Frontera. “This is not only about Puerto Rico. This is about what we will be able to show to the world, on this specific topic, what works. And what could be our future, moving forward, if we really want a more resilient and more effective lifestyle.” Nearly half of the municipal buses on the road worldwide will be electric within seven years, with China expected to dominate the global market as it aims to cut urban pollution and support domestic manufacturers.

BLOOMBERG -- The total number of electric buses in service is forecast to more than triple, from 386,000 last year to about 1.2 million in 2025, equal to about 47 percent of the worldwide city bus fleet, according to a report from Bloomberg New Energy Finance. “China will lead this market, due to strong domestic support and aggressive city-level targets,” wrote Aleksandra O’Donovan, an analyst for BNEF and author of the study. By 2025, the report said, the country will account for 99 percent of the world’s battery-powered buses. Electric buses remain more expensive up front than those fueled by diesel or compressed natural gas, but BNEF found that battery-powered buses can already offer a lower total cost of ownership when fuel and maintenance expenses are considered. Projected declines in battery prices will make the upfront costs of some electric models competitive with a diesel version by 2026, according to the study. Public buses are a key part of the urban transit infrastructure, and the fact that they serve routine, fixed routes makes them ideal for electrification. Cities across the globe increasingly see electric buses as a way to reduce local air pollution, and such municipalities as Paris and Amsterdam have set goals to switch to zero-emission buses in the coming years. Earlier this week, mayors of some of California's largest cities, including Los Angeles and San Jose, urged the state's environmental regulator to introduce incentives and requirements to spur a shift toward electric buses from ones that use diesel or natural gas. China has set the most aggressive clean-energy bus-deployment targets. Warren Buffett-backed BYD Co., China's largest seller of electric vehicles, is well-positioned to take advantage of this government push. Last year in China, BYD sold 100,183 new-energy vehicles—a category that includes full electric and hybrids), and the company’s buses now operate in 200 cities around the globe. Any price hike is likely to be small—and there are plenty of other incentives

CONSUMER REPORTS -- Even with the new U.S. tariff on imports of solar panels, this is still a good time for consumers to go solar. That's because any price increase in solar panels is likely to be minor—and there are plenty of other incentives for homeowners to make the switch. The Trump administration announced Monday that it would impose tariffs on solar panels as well as washing machines because of complaints from domestic manufacturers that they were being hurt by cheap imports. The price of solar panels, especially from China, has dropped sharply in recent years, fueling consumer demand and a booming business for U.S. solar installers. But any price increase on panels isn't likely to halt that growth, says Noah Ginsburg, a director at Solar1, a New York-based nonprofit that connects consumers with installers. For one thing, “solar panels only make up a fraction of the total cost for home installations,” he says. Most of the expense is for other costs, including labor and permits. Moreover, the tariff is temporary, says Malcolm Woolf, senior vice president of Advance Energy Buyers Group, an energy consortium. Over a four-year period, the tariff will fall from 30 percent to 15 percent. After that, there will be no tariff at all. Woolf and Ginsberg both say that solar energy continues to be a good investment for homeowners, especially in regions of the country with high energy costs, like New York State, which has the most expensive energy in the continental U.S. In fact, Woolf says that homeowners who are considering installing solar energy might want to act sooner rather than later. For one thing, one of the largest solar subsidies is going away. Currently, taxpayers can claim a 30 percent federal tax credit on the cost of solar installation. The credit decreases to 26 percent in 2020 and 21 percent in 2021, before being phased out completely in 2022. In addition to the federal subsidies, there are many state and local incentives for solar installation. In New York, for example, there is a 25 percent state tax credit, a 20 percent property tax abatement, and an up-front New York State Energy Research and Development subsidy that reduces the cost of a solar installation by 10 percent when homeowners hire eligible contractors, Ginsburg says. Even if you don't plan to install a solar energy system, the new tariff could affect you in other ways. Because solar panels have been so cheap, electric power utilities have committed to expand their use of solar to reduce their carbon footprint and meet local government sustainability standards, says Frank Maisano, spokesman for the Trade Action Coalition, which represents utilities, retailers and energy service companies, among others. In addition, large corporations such as Google, Amazon, and Walmart, in reaction to consumer demand, have committed to building large solar farms for their own energy use. Solar projects of this scale could become considerably more expensive to build, Woolf says. Eventually, these costs will be passed on to consumers in one way or another, he says. "Without a doubt, a government tariff makes solar less competitive compared to other sources," says Abigail Ross Hopper, CEO of Solar Energy Industry Association, an industry group. "However, we still believe solar is a good investment for American consumers due to the economic and environmental benefits it provides." |

James Ramos,BPII'm your go to solar energy expert here to guide you step-by-step through all of your solar options. Categories |

James The Solar Energy Expert

RSS Feed

RSS Feed