|

It’s not often we get to use the big “T” for trillion in business news. Unfortunately, this time it’s in the red.

Australia’s Climate Council has projected that the loss of coral reefs due to rising sea temperatures could cost $1T globally, based on a report which found that reefs support 500m people worldwide across 50 nations. And, while we often think of it as the environment vs. the economy… They tend to go hand-in-hand. The Great Barrier Reef is one of Australia’s greatest economic assets — bringing in over $7B per year and 70k jobs via tourism. According to the ACC, we’re in the midst of the “longest global coral bleaching event on record,” due to rising ocean temps, which since 2014, have given reefs little chance to recover. So far, ⅔ of Queensland’s Great Barrier Reef has been affected, costing the region 1m visitors a year, 10k jobs, and about $1B. Surprise! It’s directly related to climate change To battle Australia’s growing greenhouse gas emissions, the Aussie government is putting $200m annually towards preserving the reefs, including incentives for farmers to reduce waste runoff. But then again, they’re also supporting the new development of the Carmichael coal mine in central Queensland.

0 Comments

Texas is America’s oil and gas capital, but it’s clean energy that’s been increasingly powering the state over the past decade. A cleaner electric grid is great news for Texans’ health and economy, if state leaders don’t threaten progress.

TEXAS MONTHLY — Stirrings of transformation began in 1999 when the Texas Legislature deregulated the state’s electricity market, saying goodbye to monopoly providers and hello to a competitive marketplace. Competition opened the door to new players and meant power companies had to work to offer not only low-cost products, but also attributes that customers want, like clean electricity. Shortly after the market was up and running, technological breakthroughs in hydraulic fracturing—commonly known as fracking—led to natural gas dethroning coal as the country’s cheapest power resource. Natural gas prices plummeted. In fact, 2016 natural gas spot prices were at an all-time low, roughly one-quarter of peak prices just ten years earlier. Meanwhile, Texas was beginning to flex its wind power muscles. This was largely thanks to a forward-looking policy requiring a small portion of the state’s power come from renewables, effectively jump-starting the nation’s wind industry. The next key Texas policy authorized identifying areas with high potential for renewable energy—like windy West Texas—and then building transmission lines to carry that power to people. In 2002, the year deregulation began, wind made up less than 1 percent of Texas’s electricity mix. Last year, it was nearly 13 percent. And now Texas solar power is poised for liftoff. As costs come down, more and more homes and businesses are taking advantage of the sun by installing panels. Texas also is on track to become the fastest-growing utility-scale solar market in the country. This perfect storm of market, infrastructural, and technological forces is putting the Lone Star State on the path to a cleaner, more affordable energy future. Texas has everything to gain from the clean energy economy, starting with lives saved. Carbon pollution—which coal plants spew into the air—leads to asthma attacks, heart attacks, and premature deaths. One study estimated that lowering carbon pollution from coal-fired power plants could save 2,300 Texas lives and $20 billion in associated healthcare costs by 2030. The transition to a cleaner electric grid also is bringing with it jobs. Lots of them. Texas is home to nearly a quarter of the country’s wind power jobs, and the state’s solar jobs grew by an impressive 34 percent in 2016. Some people may be surprised to learn that wind and solar power now employs more than four times as many Texans as the fossil-fuel electricity industry. And energy efficiency—our cheapest power resource—supports nearly 150,000 Texas jobs. Then there’s water. Coal power guzzles water like a hungover frat boy. By harnessing the power of low-water resources like wind, solar, and energy efficiency, we could reduce this waste of precious Texas water, which could be going to our cities, agriculture, and industry. For all of these reasons and more, Texas has a lot to gain from our nationwide limits on carbon pollution from power plants, known as the Clean Power Plan. For the first time ever, the federal plan sets a pollution limit for each state’s power sector, providing states ample flexibility and time to meet that target. Plus, cleaning our air through low-carbon energy is what Texans from both sides of the aisle want—85 percent of Texas voters support increasing the use of clean power. And 71 percent of Texans support regulating carbon dioxide as a pollutant, as the Clean Power Plan would do. Many independent analyses found that states with abundant natural gas and wind and solar resources could reap the rewards of the Clean Power Plan. In other words, it is the perfect description of Texas. The Center for Strategic and International Studies estimated that, as states across the U.S. strive to meet the Clean Power Plan’s goals, Texas and two neighboring states’ net natural gas revenues would increase almost $20 billion annually. America’s solar workforce grew by 25 percent last year, while wind jobs increased by 32 percent. In fact, more than 3 million Americans now work in clean energy industries like solar, wind, and energy efficiency. Coal, on the other hand, supports around 160,000 jobs—meaning clean energy employs almost 19 times more Americans. Additionally, the state currently spends about $2 billion importing coal from outside of Texas. Rather than buying out-of-state coal, Texas should help redirect that money to creating local jobs and investment here at home by tapping more Lone Star wind and solar power. Doing so also would have a profound impact on pollution and health. According to the U.S. Environmental Protection Agency’s own scientific analysis, the Clean Power Plan could avoid up to 3,600 deaths each year. Dismantling it means sicker Texans—kids who can’t play outside or go to school, and adults who have to miss work. And though our state’s air quality generally has been improving over the past decade, Texas still holds the dubious claim of being home to three of the most polluted cities in the country, according to the American Lung Association. Fighting to keep vital climate and public health protections is essential to the future of Texans’ wellbeing and economic prosperity. On a predictably gorgeous South Florida afternoon, Coral Gables Mayor Jim Cason sat in his office overlooking the white-linen restaurants of this affluent seaside community and wondered when climate change would bring it all to an end. He figured it would involve a boat.

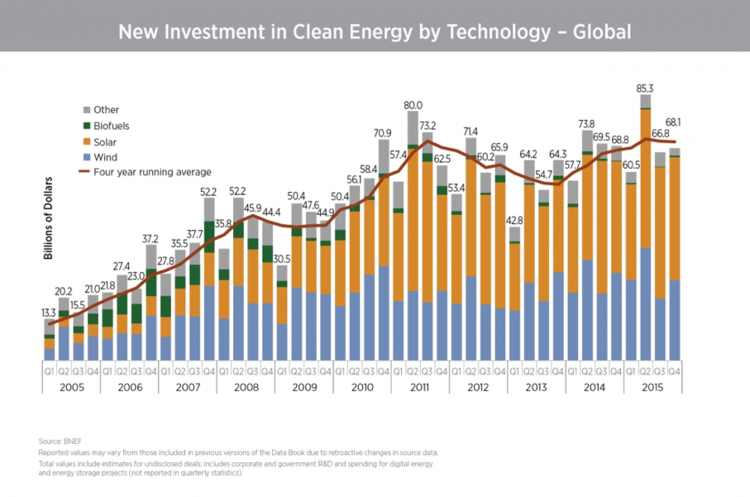

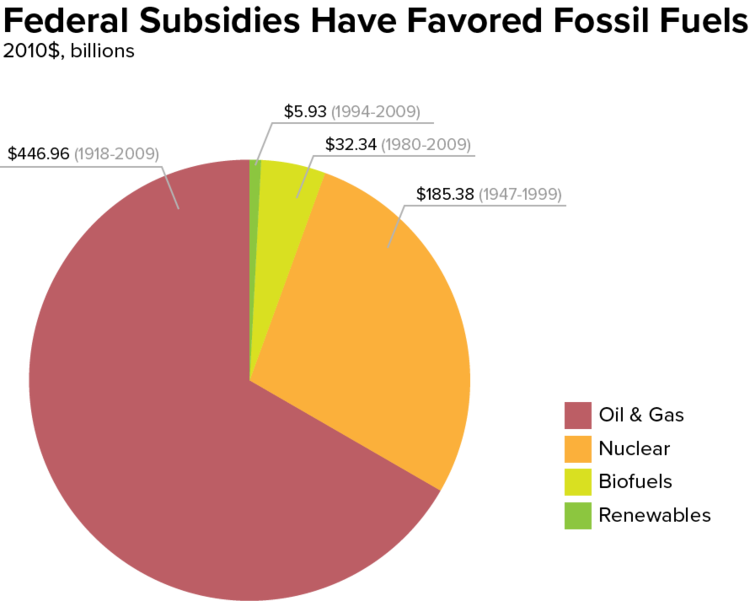

BLOOMGERG — When Cason first started worrying about sea-level rise, he asked his staff to count not just how much coastline the city had (47 miles) or value of the property along that coast ($3.5 billion). He also told them to find out how many boats dock inland from the bridges that span the city’s canals (302). What matters, he guessed, will be the first time a mast fails to clear the bottom of one of those bridges because the water level had risen too far. “These boats are going to be the canary in the mine,” said Cason, who became mayor in 2011 after retiring from the U.S. foreign service. “When the boats can’t go out, the property values go down.” If property values start to fall, Cason said, banks could stop writing 30-year mortgages for coastal homes, shrinking the pool of able buyers and sending prices lower still. Those properties make up a quarter of the city’s tax base; if that revenue fell, the city would struggle to provide the services that make it such a desirable place to live, causing more sales and another drop in revenue. And all of that could happen before the rising sea consumes a single home. As President Donald Trump proposes dismantling federal programs aimed at cutting greenhouse gas emissions, officials and residents in South Florida are grappling with the risk that climate change could drag down housing markets. Relative sea levels in South Florida are roughly four inches higher now than in 1992. The National Oceanic and Atmospheric Administration predicts sea levels will rise as much as three feet in Miami by 2060. By the end of the century, according to projections by Zillow, some 934,000 existing Florida properties, worth more than $400 billion, are at risk of being submerged. The impact is already being felt in South Florida. Tidal flooding now predictably drenches inland streets, even when the sun is out, thanks to the region’s porous limestone bedrock. Saltwater is creeping into the drinking water supply. The area’s drainage canals rely on gravity; as oceans rise, the water utility has had to install giant pumps to push water out to the ocean. The effects of climate-driven price drops could ripple across the economy, and eventually force the federal government to decide what is owed to people whose home values are ruined by climate change. Sean Becketti, the chief economist at Freddie Mac, warned in a report last year of a housing crisis for coastal areas more severe than the Great Recession, one that could spread through banks, insurers and other industries. And, unlike the recession, there’s no hope of a bounce back in property values. Citing Florida as a chief example, he wondered if values would decline gradually or precipitously. Will the catalyst be a bank refusing to issue a mortgage? Will it be an insurer refusing to issue a policy? Or, he asked, “Will the trigger be one or two homeowners who decide to sell defensively?” “Nobody thinks it’s coming as fast as it is,” said Dan Kipnis, the chairman of Miami Beach’s Marine and Waterfront Protection Authority, who has been trying to find a buyer for his home in Miami Beach for almost a year, and has already lowered his asking price twice. Some South Florida homeowners, stuck in a twist on the prisoner’s dilemma, are deciding to sell now—not necessarily because they want to move, but because they’re worried their neighbors will sell first. When Nancy Lee sold her house last summer in Aventura, halfway between Miami and Fort Lauderdale, it wasn’t because she was worried about sea-level rise, rising insurance costs, nuisance impacts or any of the other risks associated with climate change. Rather, she worried those risks would soon push other people to sell their homes, crashing the region’s property values. So she decided to pull the trigger “I didn’t want to be there when prices fell,” said Lee, an environmental writer. Ross Hancock has the same worry, and sold his four-bedroom house in Coral Gables three years ago. He described South Florida’s real estate market as “pessimists selling to optimists,” and said he wanted to cash out while the latter still outnumbered the former. “I was just worried about my life’s savings,” Hancock said. “You can’t fight Mother Nature.” Lee and Hancock are outliers. When it comes to buying homes on the coast, most Floridians are still optimists. Since the end of 2010, median home prices in and around Miami rose 120 percent, almost twice the statewide average and three times the national rate. In January, a building in Palm Beach County called The Bristol topped $300 million in units sold, achieving the distinction of the most-expensive condominium in that county’s history. A flyer for the building boasted its hurricane-resistant glass doors; it didn’t note that if seas rise three feet, the road to the front entrance could be underwater. Marla Martin, a spokeswoman for Florida’s association of realtors, said that while “of course climate change is on the radar for our members,” she hadn’t heard of clients selling homes because of sea-level rise. “I think the scientists are still trying to get a handle on it,” she wrote in an email. A short drive through mangrove trees off Highway 1 in Key Largo, Stephanie Russo’s house backs onto a canal that opens into Blackwater Sound, and from there to the ocean; her neighbors lounge in shorts and flip-flops beside their boats. A few months after Russo, a partner at a law firm in Miami, moved to Key Largo in 2015, the big fall tides brought 18 inches of water onto the road in front of their house. Unlike previous tidal floods, this one lasted 34 days. “When we bought, there hadn’t been a flood like that for years,” said Russo, who was sitting at a table between the home’s outdoor bar and its pool. “Ever,” interjected her husband Frank, who was working on the grill. The saltwater ruined cars around the neighborhood, destroyed landscaping and sparked a mosquito infestation. But the worst part might have been the trash. “When people would drive, it creates a wake,” said Russo. “That knocks over all the garbage cans, and then everybody’s garbage is floating in the streets, and in the mangroves. It’s just disgusting.” Officials in Monroe County agree there’s a problem, and plan to raise some roads in an attempt to reduce future flooding. Russo says if she knew in 2015 what she knows now, she wouldn’t have purchased the house. People buying in her neighborhood today are probably just as clueless as she once was, she guesses. “I would bet money that the realtors are not telling them.” Realtors in Florida face no legal requirement to warn potential buyers about those flood risks. Albert Slap, president of Coastal Risk Consulting, which helps homeowners and governments measure their exposure to flooding, said he thinks that will soon change: Just as the public demanded mandatory disclosure of asbestos and lead paint, people will insist on the same disclosure if a house suffers regular floods. And when that happens, Slap said, many Florida home prices will tumble. “Anybody in these floody areas, if they disclose to a buyer, the buyer probably won’t buy that property,” said Slap, whose company is doing work for the city of Miami Beach. “That’s going to drive the value down to zero, well before water is up to their front door.” Slap said the answer isn’t a mass retreat from the coast, at least not yet, but rather a version of battlefield triage: figuring out which homes are worth saving, through elevation or other means, and which can’t be helped. “The next black swan is the failure of housing finance to take climate change into account,” he said. “There will be a large number of homes that will lose substantial value, and will default on mortgages, if nothing is done to help them.” In an ornate lecture hall at the University of Miami’s School of Architecture last month, Philip Stoddard, the mayor of South Miami, sat through a presentation about the history of federal programs to purchase homes threatened by climate change, and whether those programs were likely to expand. Afterward, he invited the room to consider the sheer number of homes at risk in South Florida alone. Stoddard’s message: The government simply won’t be able rescue homeowners who wait too long to sell. “There isn’t enough money,” he said. There is as yet no federal policy on buying out properties that will be lost to sea-level rise. Last January, President Barack Obama’s administration awarded $48 million to relocate a small Louisiana town sinking into the Gulf of Mexico, the first such project funded by the federal government. But the administration made clear the project wasn’t intended to be a precedent, and it rejected a request from an Alaska village in the same situation. South Florida has likewise failed to get federal help for more modest relocations. In 2013, officials in Miami-Dade County requested $2.3 million from the Federal Emergency Management Agency for a project that included buying out a handful of homes in a low-income neighborhood called Arch Creek, far from the glamor—and tax base—of Miami Beach. “Most of those homes had 8 to 10 inches in the house,” said Terry Parker, the county official in charge of the request. The plan was to tear them down and let the land revert to creek bed. But the county never got the money and hasn’t asked for a federal buyout since. Cason, the Coral Gables mayor, said Congress ought to create what he called a “resilience fund” for homes threatened by the water—but he doesn’t think it will. The National Flood Insurance Program is up for reauthorization this year; fiscal conservatives have said they want to use that opportunity to reduce the program’s subsidies, so that people are paying something closer to the full cost of their risk. A cut in federal subsidies would particularly hurt Florida, which despite its exposure pays the lowest average flood-insurance premiums in the country, according to FEMA data. Laura Reynolds is the former executive director of the Tropical Audubon Society, Miami’s oldest environmental group; she’s lived in her house in Cutler Bay, an hour’s drive south of Miami, for 13 years. She said she had once hoped to pass it on to her niece or nephew, but now plans to sell. “The future of our coastline is completely doomed,” Reynolds said. “The question is, how long will we have?” Now is not the time to lose hope, quite the opposite, actually. It's clear that the sustainable energy growth will remain positive, even if not federally backed. SUSTAINABILIST — While Washington sees climate change as a partisan issue, Mike Bloomberg told Time “climate change is one issue where cities are willing to take action and clean the air, support building modern infrastructure, save money on energy, protect themselves from extreme weather, and attract new businesses.” As Bloomberg suggests, Deepwater Wind’s South Fork plant is just part of Governor Cuomo’s ambitious plan to reach 50 percent renewable energy by 2030. In addition, foreign nations will encourage competition, business will hedge risk, and consumers stay forward-looking. Thus, without having to be too optimistic about the current President’s allegiances, one can firmly state that clean energy investment will continue to be on the rise for the following five reasons: Momentum -- The economic wave of shutting down dirty coal will continue and investments started in the last administration, like Deepwater Wintake years to complete; Global Competitiveness – as countries like Germany, China, and India continue to invent and invest, the U.S. will need to stay on par in order to thrive in the burgeoning green energy market; Financial Incentive – no longer is there a need to sacrifice dollars for morality, as there is support extended both federally and locally, and the technology has improved to where the economics speaks for itself; Corporate Leadership – being green and setting internal renewable energy goals for CSR is no longer just greenwashing as companies are competing to run at lower operating costs to gain recognition; and Looking toward the Future – It's critical to start the inevitable transition sooner rather than later and states are already forging ahead. For those of you looking to dig deeper, let’s review each of these points in more detail. MOMENTUM “Renewables are becoming ever more central to our low-carbon lifestyles, and the record-setting investments in 2015 are further proof of this trend” -- UN Environment Programme Executive Director Achim Steiner (World Economic Forum). In 2015, for the first time, more renewable capacity was created worldwide than conventional fossil-fuel generation. The International Energy Agency projected that renewable energy will continue to grow by 42% globally by 2021. In addition, the Energy Information Administration published that in 2015, 18GW of capacity were retired and more than 80 percent of the capacity was coal-fired. More than 27GW of utility-scale projects were projected to replace it, and much of the new generating hardware is wind and solar, which typically have a capacity factor in the area of 30 percent. What does all of this mean? This means that three times as many wind and solar projects were put online in 2015, just to replace the coal-fired power plants that were taken offline, and that doesn’t count the extra 9 GW of additional energy brought online. Unsurprisingly, these projects were followed in 2016 by a litany of bankruptcies amongst even the biggest coal companies including the top grossing energy company in American history, Peabody Energy. These transitional steps are near impossible to reverse. The chart below shows just how much money has been invested over the years globally. The aggregation of the investment only is greater over time. Furthermore, infrastructure projects take years to get off the ground and it is unlikely that projects that have been started will be deterred from completion, or use, simply due to potentially unfavorable national political climate or policies. We can see that more funding has been put into solar energy in the last five years than in the prior five combined, and there is a clear reduction in investment in biofuels. This interest in solar is because of the affordability of the technology, despite not doing well initially. For perspective, Solyndra, possibly one of the worst examples of a solar technology company, went nearly defunct in 2011. After receiving $535 million dollars in bailout money from the federal government, Solyndra was in the black only three years later in 2014. Thus, albeit a hard market to get off the ground possibly, this investment by the previous administration in supporting the industry will continue to pay off as the country reaps the benefits of the groundwork laid. GLOBAL COMPETITIVENESS “The wealth of a nation is its air, water, soil, forests, minerals, rivers, lakes, oceans, scenic beauty, wildlife habitats and biodiversity… that’s all there is. That’s the whole economy. That’s where all the economic activity and jobs come from. These biological systems are the sustaining wealth of the world.” – Gaylord Nelson After the Paris Agreement last November, it is clear that the rest of the world is very interested in making promises to change their behavior and keeping them. All countries are looking to find that balance between mastering economic growth with hitting GHG targets and those that get there first are more energy secure in our world of with scarcer and more expensive resources. Thus, in much of the global economy energy has become a strategic factor to create competitive advantage. The country to corner the market on cleantech could be equivalent to the oil empires of yesteryear, but the race to a competitive advantage lies in almost every sector, including transportation, logistics, manufacturing, building technologies, construction, and engineering. Even the oil-rich Middle East knows the inevitability of this movement as the region tripled its renewable energy investment in 2015. While the EU is also pulling back after years of generous renewable subsidies, they have interconnectivity and years of progress in their back pocket. Germany, Spain, and the Czech Republic have all cut back on public funding and, in January 2015, the U.K. slashed subsidies for rooftop solar panels by 87 percent. Yet, as they hoped the industry is thriving as the EU has been the world’s renewable energy powerhouse. The 2001RES-E directive on the promotion of electricity from renewable energy sources constitutes the earliest most significant piece of legislation for renewable electricity in the world. The EU’s interconnectivity gives them a benefit as diverting the power from baseload plants elsewhere when the renewable energy is low has proven to be more cost effective and energy efficient than taking them offline. Germany, one of the countries that is well positioned in the race for market share, is already gaining clear international lead in some sectors as they have a head start and can leverage competencies in energy and energy efficiency to expand their strong position on world markets. They do this by developing and testing new solutions, improving their energy productivity, pioneering new technologies in places of opportunity in the market. For example, German car-makers and their suppliers are among industry’s worldwide leaders, and those car-makers that adapt successfully can capture around EUR 325 billion total for just having energy-efficient motor systems in 2020. In terms of overall investment, China is leading the charge towards a renewable future. Their total spent topped $100bn, which accounted for over a third of the total global investment. Other countries also saw significant increases in their green investment from 2014 to 2015. Chile, South Africa and Mexico all saw spending rise by over 100% on the previous year’s total. If that doesn’t light a fire under the U.S. to remain on the global playing field, nothing will. FINANCIAL INCENTIVE The reality of the situation is that “no longer is there a trade-off between what you believe in and what you can make money off of” -- Nancy Pfund, a founder and managing partner of DBL Partners, which made early investments in SolarCity and Tesla (New York Times, January 6, 2017) Another argument as to why there has been so much growth is the large federal renewable energy tax credits afforded to those that make qualifying technological investments. Legislation extending the Solar Investment Tax Credit (ITC) was approved by a Republican controlled Congress on December 18th, 2015, extending the 30% Solar Investment Tax Credits for both residential and commercial projects through the end of 2019, and then drops the credit to only 26% in 2020. SEIA cites the extension as the reason that the U.S. will have installed approximately 98 GW of PV and 2 GW of concentrating solar power (CSP) to total 100 GW of solar electric capacity by 2020. This is enough capacity to power more than 20 million homes. It is widely known that the fossil fuel industry is propped up by subsidies and any (mis)understanding that the renewable energy market couldn’t be successful on its own is only because of the government thumb on the scale tipping it in favor of the competitors. According to David Hochschild, a commissioner with the California Energy Commission, “There is a myth around subsidies, but there is no such thing as an unsubsidized unit of energy.” Still, he continued, “you put subsidies in renewable energy and costs go down to the point where they are not needed any more. Thus, government subsidies may have helped wind and solar get a foothold in global power markets, but economies of scale are the true driver of falling prices. Federal subsidies have provided wind and solar developers with as much as $24 billion from 2008 to 2014, according to Bloomberg New Energy Finance.

"We're in a low-cost-of-oil environment for the foreseeable future," Michael Liebreich, chairman of the advisory board for Bloomberg New Energy Finance (BNEF) said during his keynote address at the BNEF Summit in New York in April 2016. "Did that stop renewable energy investment? Not at all." The 12-fold increase in installed capacity over the past decade is known to have helped lower costs at least 10 percent each year. Based on this math, even without the government help the industry will not be dropping off a cliff. Many states are even experimenting with a wide range of approaches to incentivize investment, innovation, and installation of renewable energy through creative legal tools in subsidies, tax breaks, and loans. States have the option to adopt many different types of financial incentives, which could be classified as:

DSIRE charts out the options by state and by approach, allowing for easy comparison. Whether you’re a stakeholder, non-profit, or government worker the sheer variety can be overwhelming but it is incredible that so many states are attempting this work and many are learning from others who have been successful in their campaign. CORPORATE LEED-ERS "A few years ago Walmart decided to put solar panels on the roof of the store. You replaced some traditional lightbulbs with LEDs. You made refrigerator cases more efficient. And you even put in a charging station for electric vehicles. More and more companies like Walmart are realizing that wasting less energy isn't just good for the planet, it's good for business. It's good for the bottom line." – Barack Obama (Forbes) Companies both small and large are finding renewable energy investment great for improving their bottom line, bolstering resilience, and gaining reputation. Most companies by now have realized the truth of a resource-constrained world and that to avoid basic existential risk and maintain competitiveness they must use more efficient technology and strive to rely less on water and fossil fuels. The “energy-water-food” nexus hits businesses first as the largest consumers, and smart companies are hedging their reliance as they look out for these risks not only as they see it now but as the situation is due to worsen. The companies that have analyzed and addressed the inefficiencies in their operations will thrive 10-15 years down the line and have received a reputation boost to boot. Ladership in the corporate world is as important as ever as consumer activists speak with their dollars. Kohl’s envelopes advertise: “Kohl’s is LEED-ing the way with more than 40 million square feet of LEED certified space.” EPA honored Kohl’s in 2016, procured 1.4 billion kilowatt-hours of green power in 2015 through more than 60 long-term solar PPAs, Kohl’s-owned solar systems that generate green power on-site, and by purchasing renewable energy certificates. Kohl’s also installed three new solar trees at its Innovation Center and achieved net-zero emissions for its Scope 2 electricity use through 2015. The giant Walmart, “long time bogeyman of the left,” has also now become the poster child of energy consciousness on a commercial scale. Corporate responsibility and good P.R. go only so far in saving money, but these efforts are far from greenwashing as when you’re Walmart and your energy bill is to the tune of $1 billion per year. Kohls and Starbucks also boast to the tune of being more than 70% carbon free. Were Walmart to follow this approach it could offset its 20-million-ton-per-year carbon dioxide footprint for a mere $200 million. Now, SolarCity has installed backup Tesla batteries which will help Walmart save even more. Bloom Energy, whose innovative fuel cells called "Bloom boxes," also use a clean electrochemical process to transform natural gas into electricity. Today 42 Walmarts in California have Bloom boxes, saving Walmart 20% compared with grid power and emit around 35% less carbon than large-scale power plants. The company said it planned to be 50% powered by clean and renewable energy sources by 2025. With all of these innovations getting more and more affordable, there are significant opportunities for utilities and companies to rethink their business model. Every company is producing yearly sustainability reports and as less money spent on inputs, shareholders and officers alike are happy to know this means those dollars are freed up to be spent elsewhere such as growth, infrastructure, or operating costs. LOOKING (NATURALLY) TOWARD THE FUTURE “The future is green energy, sustainability, renewable energy” – Arnold Schwarzenegger Businesses continue to thrive in a market that has never been more global and must remain responsive to forward-looking foreign countries, bold domestic localities, and conscientious consumers. It may seem a rudimentary argument, but progress is inevitable. States and cities, known to be the hotbed of experimentation, are all about the trend toward renewable energy. States are naturally pushing for the change. Arkansas has already reached its 2030 compliance goal under the Clean Power Plan because it already relies so heavily on renewables and natural gas. Michigan’s Attorney General is also fighting the Clean Power Plan in court even though the state “would be largely in compliance” with the rule under expected “business as usual” conditions, according to a recent report by the Electric Power Research Institute. In conclusion, while partisanship on this issue has been fierce on a federal level, it's clear that the cities, states, businesses, and the globe are set on a path toward an ever-growing green energy future that cannot and will not be altered. Internationally, countries have come together to lookout for our collective resources, address the specter of climate change, and set goals in the hopes of avoiding existential catastrophe. Based on our evidence, rolling back any headway that we have is appears inconceivable to the point that the only real answer is to jump on board the renewable energy and sustainability train. The company says the farm will give jobs to displaced coal miners.

THINKPROGRESS — A Kentucky coal company announced Tuesday that it is planning to build a solar farm on a reclaimed mountaintop removal coal mine and that the project would bring both jobs and energy to the area. Berkeley Energy Group, the coal company behind the project, billed it as the first large-scale solar farm in the Appalachian region, which has been hit hard by the decades-long decline in the U.S. coal industry. The company, in partnership with EDF Renewable Energy, is currently conducting feasibility studies for the project on two reclaimed strip mines, both located in the eastern part of the state. Berkeley Energy Group estimates that the solar farm could produce as much as 50 or 100 megawatts of electricity, which would be five to ten times the size of Kentucky’s largest solar farm. Berkeley Energy Group’s project development executive told the Louisville Courier-Journal that the company did not intend to replace its coal production with the solar farm, but instead viewed the project as a chance to reclaim used land while creating job growth in the area. “I grew up with coal,” said Ryan Johns, BEG project development executive. “Our company has been in the coal business for 30 years. We are not looking at this as trying to replace coal, but we have already extracted the coal from this area.” Coal, which for decades has been the primary source of electricity production in the United States, has suffered from competition with cheaper sources of energy like natural gas, as well as solar and wind. Increased automation and stronger environmental regulations have also pushed the industry into decline. According to the Louisville Courier-Journal, coal extraction in Eastern Kentucky fell from 23 million tons in 2008 to about 5 million tons last year. Over the same period of time, mining employment dropped from 14,373 to 3,833. As a candidate, President Trump seized on the high unemployment among coal miners in Appalachia, promising that he would bring coal mining backif elected president. In office, he has signed a handful of orders and laws that he argues will help bolster the declining industry — though energy experts, coal executives, and even Republican politicians contend that the market for coal looks bleak and that Trump’s orders will do little to change that. At the same time, renewable energy employment has been increasing across the country. According to a Sierra Club analysis published earlier this year, clean energy employs more people that fossil fuel jobs by more than 2.5 to one — and renewable energy jobs exceed fossil fuel jobs in almost every state. In recent years, solar and wind jobs have grown at a rate 12 times faster than the rest of the U.S. economy. Former Kentucky Auditor Adam Edelen, who is involved in the solar farm project, told the Louisville Courier-Journal that interest in the project has so far been high, citing the compelling narrative of bringing in new jobs for unemployed coal workers and the partnership between renewable energy and coal. And many companies based in Kentucky are looking to renewable energy as a way to lessen their carbon footprint, pushing the state to embrace forms of energy other than coal. Kentucky, unlike many states in the nation, does not have a renewable portfolio standard — and the state’s supply of cheap of coal makes it hard for renewables to compete there. Still, if the Berkeley Energy Group’s solar farm is completed, Kentucky would hardly be the first deep-red state to embrace large-scale renewable energy. Texas, Iowa, and Oklahoma are the top three states in the country when it comes to installed wind capacity, with Kansas coming in fifth (behind California). And when it comes to solar, North Carolina, Arizona, and Nevada are the second, third, and fourth states in the nation with regards to installed solar capacity. There has been a big surge in the number of households installing solar panels, with March installations reaching their highest level in almost five years.

Key points:

Warwick Johnston from energy consultancy firm Sunwiz crunched the numbers and said 91 megawatts of solar photovoltaic (PV) systems were installed during the month. "March has been a very impressive month for 2017," he said. "We already saw a surge starting to build up in 2016, and we were wondering if that was going to continue into 2017 and it really has just continued to skyrocket." Queensland led the way, installing 25 megawatts of capacity, which is enough to power about 5,500 homes and businesses. Installations were also up in South Australia, New South Wales and Victoria. Mr Johnston said the recent blackouts in South Australia were a factor in the rising demand. "People are certainly aware of the benefits of solar power and storage to offset or protect against grid blackouts, and that has been a driving factor in the uptake of solar," he said. "We're seeing the uptake occur in states which weren't affected by those blackouts as well, so it really is people being aware that solar panels are a great way to beat rising electricity bills." Installation figures in Tasmania, the Northern Territory and the ACT were flat. Warwick and Lola Neilley recently installed a four-kilowatt system on the roof of their home in Melbourne's northern suburbs. "We are paying basically $2 dollars per month in electricity," Lola Neilley said. "It's an incredible saving, and [there is] the peace of mind that we are not at the mercy of the commercial interest of the privatised distribution of electricity." Mrs Neilley said a lot of people in her neighbourhood had installed solar panels. "The council have what they called the 'nonna effect' where one grandmother installs the solar panels and tells the others," she said. Sarah McNamara from the Australian Energy Council said it was not surprising consumers wanted more control over their power bills. But she said it added a layer of complexity to the energy market. "It gives retailers opportunities to provide attractive options for their solar PV customers in terms of the feed-in tariffs they're offering and perhaps other services as part of a retail package," she said. "For the national energy market (NEM) it means there is more intermittent generation in the market. "It's a good thing that there's more generation but a challenge for the NEM, because when the sun isn't shining in the area you live in then you are not able to generate electricity for your own home or to put back into the electricity market." She said batteries were potentially an important part of the solution going forward. "The difficulty at the moment is that batteries are still extremely expensive, around $10,000 for your average domestic-sized battery unit," she said. "Overall, what we would say is what we need is good policy settings that are bipartisan at a federal and a state level, because then investors might consider investing in firm generation." At first, switching to solar energy may seem like an intimidating change, but it’s actually a simple transition that comes with insurmountable benefits - the most immediate being the money you’ll save on energy bills from DAY ONE.

But there's more to solar energy than simply saving money. Here are all the outstanding benefits of switching to solar power. Save on Your Energy Bills The most obvious and noticeable outcome of installing solar panels on your home is the immediate savings you’ll notice on energy bills. And the best part is you don’t have to worry too much about how big your solar panel installation is - however many panels you decide to have installed, you’ll be saving money. Of course, the bigger the installation, the more money you’ll save, going up to having ZERO expenses on monthly electricity. If you love numbers The average for energy savings in a 20-year time span for Americans is roughly $20,000. In more populous areas (like New York), the savings can go up to $30,000. In Hawaii (where the sun is ever so present), the savings got close to $65,000. Add Value to Your Property Homes with solar panels will automatically increase on market value and sell faster as well. A research showed that homes with solar panels sell 20% faster and for 17% more money (Source: NREL) Do you know about solar incentives? Many states in the country have incentives to photovoltaic (PV) adoption. It varies from one state to another, but in almost every case, you won’t have to pay the entire installation by yourself - in some cases, you can even get paid for producing solar energy. Read more about these incentives here! Reliability and Security No one can charge you for sunlight. For that reason, sun power will always be a secure method for generating energy, and it’s just as reliable too - you can always project how much energy will be generated, as the sun never stops rising, no matter where you are. The Earth Thanks You The environment greatly benefits from the use of solar energy instead of nuclear power plants:

In the year 2000, the entire world had roughly four gigawatts of solar power capacity installed, and it didn't seem to be going anywhere fast. In 2002, the International Energy Agency forecast suggested that, by 2020, global solar capacity would still be hovering at around 10GW and still barely register on the global energy markets.

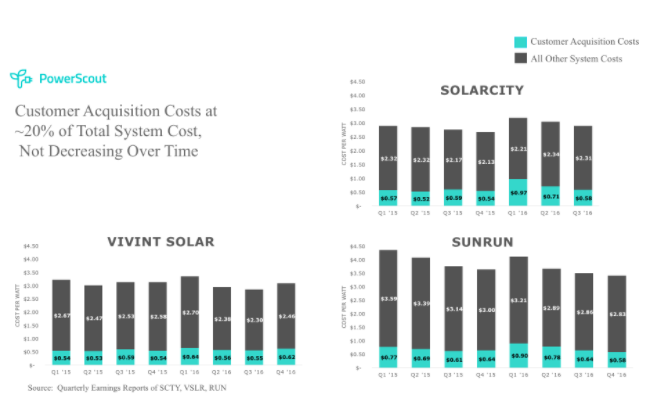

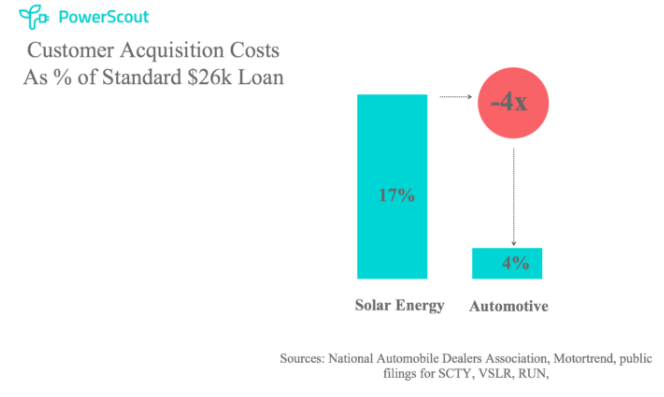

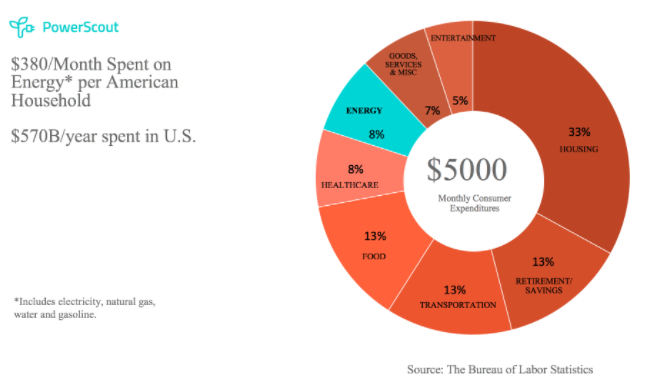

ARS TECHNICA — How things change. Over the 15 years that followed, solar energy capacity expanded by 5,700 percent, reaching 227GW. The International Energy Agency revised its solar estimates upwards three times over that span, but its most recent estimate—over 400GW of installed capacity by 2020—is already falling behind the curve of solar's growth. In 2015, the most recent year that numbers are available, 57 gigawatts' worth of solar panels were shipped. That's enough to add 400GW of new capacity in seven years, under the completely unrealistic assumption that our manufacturing capacity won't expand in the mean time. If most projections have been wrong, is there anything we can say about the future? An international team of energy experts makes an attempt to figure out where solar might be going out to the 2030s, when they expect we'll have terawatts' worth of photovoltaics on our grids. Their analysis includes many of the highlights above, along with a few more. For example, it notes that power purchase agreement prices for solar power have dropped by about 75 percent over the last seven years alone, leaving them at about $50 per megawatt-hour in the US. Globally, many sites are seeing prices approach $30/MW-hour. For those reasons alone, the authors expect that the US will continue to install from 10 to 15GW of new solar annually through 2020—about double the rate that Germany peaked at earlier this decade. Globally, solar manufacturing capacity will head up to 100GW annually. Future tech But to a certain extent, solar is now the victim of its own success. As it rapidly became commoditized, the investment money needed to continue to expand manufacturing capacity has begun to tail off. Investment for research into new technology is also constrained. But, they say investment now could really pay off. It's plausible, they argue, to get the levelized cost of solar power down to a quarter of what it is now, to the $30/MW-hour range. For context, that would be a third the cost of coal and half the price of natural gas. Doing so, however, would require a large set of optimizations: more efficient panels, lower manufacturing costs, cheaper components, and so on. Some of these are already in the works. First Solar, the authors say, has plans to produce panels for even less than would be needed to reach that goal. And, after years of stagnation, silicon's efficiencies have crept up. The two major thin-film techs, CIGS and Cad-Tel, have also seen efficiencies rise. And there's always the chance that emerging tech like perovskite cells will take off. It's also possible to shift the financials dramatically by increasing the durability of panels. Tech has been demonstrated that lowers the drop in efficiency to about 0.2 percent a year, which would leave panels usable for up to 50 years. That would give solar installations lifetimes that exceed those of many fossil fuel plants and would allow a return on investment over a much longer period. Grid management Going well below the costs of fossil fuels may be essential to the continued expansion of solar. The authors note that a variety of studies have suggested that it becomes challenging to stabilize the electric grid once variable sources exceed 30 to 40 percent of the total electricity supply. Adding batteries could essentially change solar from a variable energy source to a dispatchable one. Right now, however, with solar more expensive than most other energy sources, tacking on batteries is simply not economically feasible. But the authors suggest that, by 2030, projections of battery tech and costs, combined with their projections for solar power, would leave solar + batteries competitive with current coal prices. In addition, batteries can serve a variety of functions in stabilizing the grid. Specifically, they can be managed to respond to sudden changes in supply or demand. Currently, that function is provided by the inertia of the large spinning hunks of metal found in traditional generators, but those will become less common on an increasingly renewable grid. The authors note that better grid management could also mitigate some of the challenges posed by intermittent energy sources. This includes demand-response, in which customers receive benefits for delaying high-energy-use activities until the supply of renewable energy is abundant. This could involve anything from being able to set your washing machine to start its run once electricity prices drop below a set point, to over-cooling or heating buildings overnight, allowing them to use less power the next day. It's also possible to have grid-aware management of the batteries of electric vehicles, which should be present in much larger numbers if the battery improvements mentioned above come to be. By slightly adjusting the rate of charging of millions of vehicles, a grid could easily tolerate temporary bumps in supply or demand. If all of this comes to pass, the authors suggest, it's possible that the world will have somewhere over 5 terawatts of solar capacity by 2030. And, if we get there, we'd have the manufacturing capacity to install another terawatt annually throughout the 2030s. Even if the panels only produce 30 percent of their optimal capacity, that would still take a big chunk of global power demand, which currently requires about 15TW of generating capacity. The past year has seen four major national solar brands surrender. Sungevity and SunEdison declared bankruptcy, NRG scaled back to focus exclusively on commercial and utility-scale solar, and SolarCity was brought under the Tesla umbrella. GREENTECH MEDIA — The retreat of these national players coincides with record growth and all-time highs across all sectors of the solar industry. Despite investor jitters and doomsday headlines, consumer demand for solar is increasing at an astonishing pace. The problem plaguing the market is not demand, but how demand is being met. Many articles have analyzed the cause of the current turmoil and what it means for the industry going forward. In a recent GTM article, Andrew Beebe pointed to a rapid commoditization of hardware and financing, as well as a proliferation of specialized productivity tools, to explain how local solar installers have steadily eaten up market share from the retreating national brands. The overhead-intensive, vertically integrated model has given way to more agile local providers who can deliver better service and better pricing. We at PowerScout have seen this trend developing firsthand throughout our partner network. Customer acquisition costs are the next big challenge for solar Beebe ends his post by pointing out one area of the solar cost structure that has not budged, even as the other components have seen 10x reductions in the past decade: customer acquisition costs. Sales and marketing now represent the largest cost category in a residential system. This pain point becomes even more obvious when you compare customer acquisition costs in solar to other more mature industries like auto sales. In solar, 17 percent of the system purchase price is used to cover the installer’s sales and marketing expenses, while only 4 percent of the purchase price of a car is used to cover sales and marketing Residential solar customer acquisition costs are now twice as expensive as the actual solar panels, the most important component of the system. This is crazy. U.S. residential solar 2.0 at $2 per watt In 2016, the average fully loaded residential solar installation in the United States cost between $3.00 and $3.50 per watt. The average system in Europe, however, is being sold at or below $2.00 per watt. In order for the U.S. residential solar market to move from a niche market (~1 percent penetration) to mass market, customer acquisition costs must be reduced by an order of magnitude. Achieving this goal requires a fundamental shift in the way solar is sold. And herein lies the big challenge. While local installers can deliver high-quality solar installations, they are rarely marketing experts. There are obviously local and regional installers who have a superb ability to bring in new customers, but in a fragmented “long tail” market, there are many installers who simply don’t have the time or resources to invest in developing cutting-edge customer acquisition techniques. To fill this gap, local installers resorted to a cottage “marketing” industry leveraging lead generation techniques that are far from consumer-friendly. Installers buy a lead for $60 on average (prices vary significantly by geography and level of exclusivity) and then go through a laborious qualification process to target the most promising customers. An installer can spend $6,000 for 100 leads, but only 10 will actually qualify and be interested in hearing the installer’s pitch. Moreover, three will sign contracts, and only two will actually follow through with the installation. That means that on average, a solar installer is paying roughly $3,000 -- or $0.40 to 0.50 per watt -- on marketing for a single deal before factoring in sales commissions and the overhead required to manage that funnel. Marketing is changing faster than at any point in history Even the installers that have established robust sales and marketing teams face an uphill climb. With the advent of social media and content marketing, the way consumers absorb information has fundamentally changed. Programmatic advertising allows marketers to target consumers with laser precision, serving the perfect ad to the perfect prospect at the perfect time and in the perfect place to drive conversion. Simply bidding on keywords, getting five-star Yelp reviews, canvassing, and sending generic direct mail isn’t enough to enable the drop in customer acquisition costs that will be required to scale. Also, while residential solar productivity software can help installers be more efficient when designing systems and managing the customer relationship, it does not help installers address the marketing challenge. A brand that consumers trust The residential solar 2.0 model needs to put consumers front and center, using cutting-edge data-driven sales and marketing techniques combined with a seamless installation experience. It calls for a model with centralized marketing and distributed fulfillment. This model is already emerging in Europe, with trusted consumer brands like Ikea acting as the central hub for customer acquisition while a network of local installation partners provide fulfillment and project management services. In the United States, brands like Tesla are well positioned to deploy this model. Other household brands like Amazon and Home Depot can leverage their intimate understanding of consumers and established brand loyalty to acquire customers, and can then partner with the long tail of installers for fulfillment (e.g., Amazon Home Services). How is solar different from HVAC or roofing, where decentralized marketing seems to work just fine? First, solar panels don’t represent an obvious need. Consumers are accustomed to receiving electricity from their utility and, unless there’s a prolonged blackout, there’s no urgency to switch to solar. In contrast, a broken heating system or roof represents an immediate need to consumers. Second, the decision to purchase an HVAC system or a new roof is most often driven by a breakdown or leak that requires a quick fix. In these cases, consumers want to find the best contractor quickly. Third, solar energy has complexities that the other categories don’t have: unfamiliar technology, complicated policy and regulatory frameworks (e.g., net metering), the need for long-term financing, tax credits, and an arduous permitting process. For these reasons, solar has to be actively marketed to generate consumer demand, while demand in other categories is need-based and the product is well understood. A trusted brand could be immensely valuable to commercializing a product like residential solar. Name brands are built over decades from immense capital investments into product, marketing and customer experience. That is why it's extremely difficult to build a brand in a nascent industry like solar energy where, with a few exceptions (Tesla), nobody has the deep pockets to spend on brand-building. In addition to carrying credibility with consumers, an established household brand can leverage the latest marketing techniques and a cohesive user experience to seamlessly bridge the online and physical worlds. A mature brand understands how to inspire customers, and could portray solar as a stepping stone to a complete smart-home transformation. These brands will have an intimate, data-driven understanding of the consumer's home and lifestyle and can help optimize energy usage for comfort, savings and environmental footprint in a seamless way long after the initial sale. Today, the smart home is defined by myriad disparate gadgets, but tomorrow it will be an integrated AI-driven ecosystem of appliances, sensors, and massive amounts of data. Electrification of transportation and low-cost battery storage will further accelerate the need for energy optimization. Local installers play a key role in this ecosystem by continuing to operate a distributed fulfillment network that focuses on capital-efficient operations. The major optimization lever for local installers will be labor utilization rate -- in other words, the percentage of time crews are fully utilized on actual jobs. They will take advantage of technological innovations, such as AC solar panels, that can help to decrease the number of labor hours applied to a particular job. Who will be the dominant solar 2.0 brand? 2017 is the year of a massive makeover. The residential solar delivery model has to be drastically revamped. This is an opportune time for established household brands to make big bets on the U.S. residential solar industry and start putting together the pieces of the puzzle required to own the connected smart home beyond just gadgets, with solar as a centerpiece. This does not mean that vertical integration is required. However, ownership of the customer relationship beyond the initial sale will be key. There is no doubt that the long tail of installers will have an important role in making this model succeed. U.S. residential customers spend $570 billion every year on energy and fuel. That is $380 per month per U.S. household, or 8 percent of the average consumer’s budget -- similar to healthcare and more than purchased goods and entertainment. Multiple brands will play a leadership role. The key will be a data-driven understanding of consumers and managing a fulfillment network. It is easy to imagine a world 10 years from now where Tesla has the best advanced energy products and Amazon is the world’s largest energy services provider. In this world, 10,000 kilowatt-hours and 10,000 miles (think autonomous EVs) are ordered online as quickly and easily as laundry detergent -- all at a fraction of the cost that electric utilities could deliver.

It all starts with a brand consumers trust, a lot of data to understand the consumer and their energy needs, and a high-quality distributed fulfillment network. What role will utilities play? Utilities need to be active participants in reframing the current regulatory context and work hard on drastically improving consumer engagement. Assets in the rate base can not be the sole optimization function. If they don't find new ways to work with customers, they may run the risk of becoming wire operators. Residential solar 2.0 will be about cutting-edge marketing at large scale delivered by a handful of trusted brands, enabling the long tail of local installers to do what they do best: deliver high-quality installations. This powerful partnership has the potential to make solar energy a mass-market product Americans used more renewable energy in 2016 compared to the previous year, according to the most recent energy flow charts released by Lawrence Livermore National Laboratory. Overall, energy consumption was nearly flat.

LAWRENCE LIVERMORE NATIONAL LABORATORY — Each year, the Laboratory releases energy flow charts that illustrate the nation's consumption and use of energy. Americans used 0.1 quads (quadrillion BTU), more in 2016 than in 2015. A BTU, or British Thermal Unit, is a unit of measurement for energy; 3,400 BTUs is equivalent to about 1 kilowatt-hour. Prices for photovoltaic panels have fallen dramatically over the past decade, contributing to solar energy's rapid growth, which rose by 0.15 quads or 38 percent in 2016, with significant additions in the electricity, commercial and residential sectors. "Two thirds of that increase was in the electric sector," said A.J. Simon, group leader for LLNL's energy program. "These are large installations of thousands of solar panels, usually in the desert." Installations on the roofs of homes and warehouses account for the rest of the additions. Likewise, more wind power is contributing to the nation's utility grid. Use of wind power rose by 19 percent or 0.33 quads. "Generous incentives for renewable energy, combined with improved 'know-how' in siting and building wind farms, has led to a favorable environment for growth in this sector," Simon said. Coal use decreased by 9 percent to 14.2 quads, mostly due to decreased coal supply to the electricity sector. That supply has been replaced by wind, solar and natural gas. Overall, natural gas use rose by 1 percent to 28.5 quads. Energy use in the residential, commercial and industrial sectors all declined slightly, while consumption of fossil fuels in the transportation sector rose by 0.5 quads or 2 percent. All energy use results in some losses, shown on the charts as rejected energy. This energy most often takes the form of waste heat, such as the warm exhaust from automobiles and furnaces. The efficiency of the nation's cars, lightbulbs and factories determines how much waste heat is produced, and how much fuel and electricity can be put to productive use. This year marks two changes to the energy flow chart. The Energy Information Administration has changed the way it analyzes and reports renewable energy use, and those changes are reflected in the 2016 chart as well as a revision to the 2015 analysis. Additionally, the estimate of efficiency of the industrial sector has been reduced from 80 percent to 49 percent to align with recent analysis at the DOE's Advanced Manufacturing Office. LLNL reports all year-over-year changes on a basis consistent with the new methodology. |

James Ramos,BPII'm your go to solar energy expert here to guide you step-by-step through all of your solar options. Categories |

James The Solar Energy Expert

RSS Feed

RSS Feed